We’ve passed the annual performance test

Since 2021, the Australian Prudential Regulatory Authority has conducted an annual performance test for MySuper products. The test is intended to hold super funds to account for underperformance through greater transparency and increased consequences. In 2023 this test was extended to also apply to Trustee-Directed Products (TDPs).1

We’re pleased to confirm that Mercer Super has passed the annual performance test for 2025, as well as for all other years since it was first introduced in 2021.

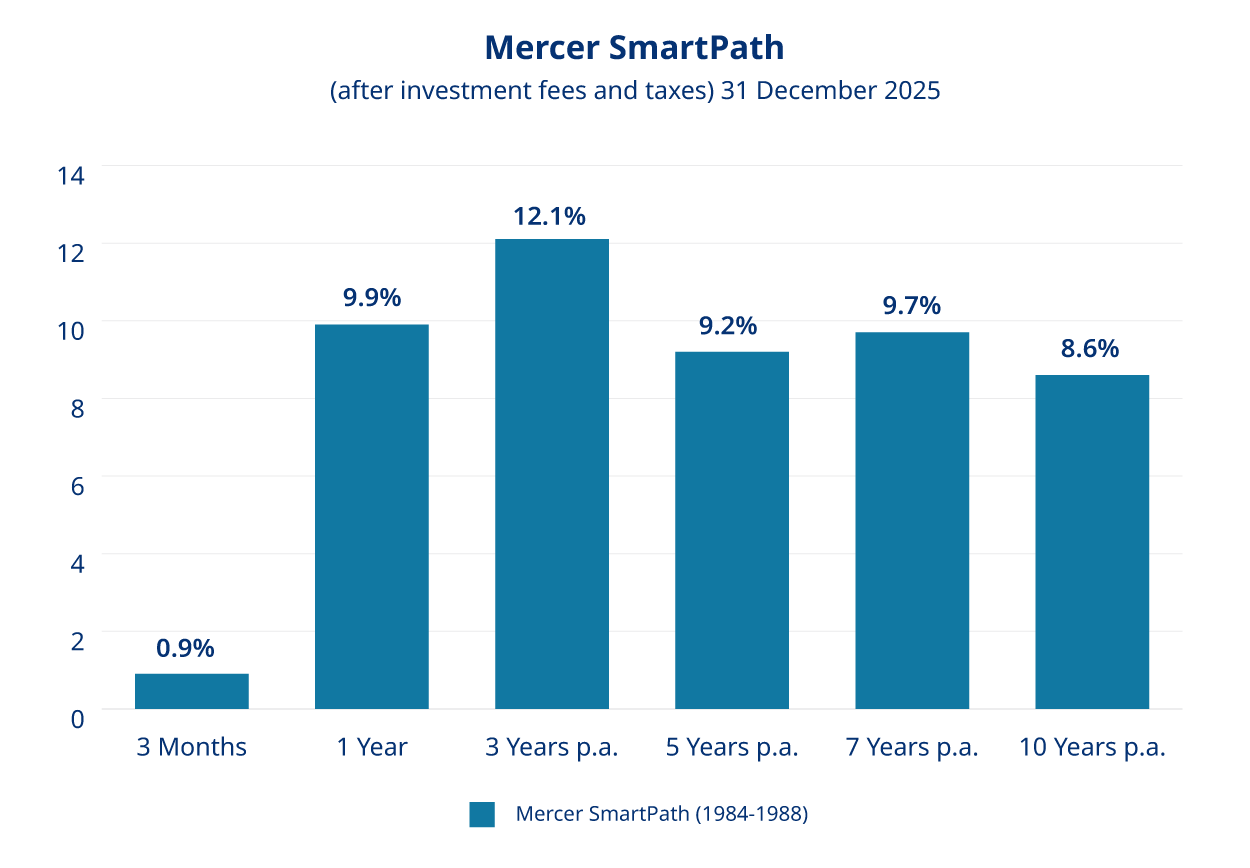

Mercer SmartPath performance

Q4 2025

For the last quarter of 2025 our default investment option, Mercer SmartPath, delivered positive returns for Mercer SmartPath members, with returns ranging between 0.7% and 1.0%.2

12 months

For the 12 months up to 31 December 2025 Mercer SmartPath members enjoyed positive returns ranging from 7.2% to 10.7%.2

10 years

While over the 10-year period to 31 December 2025 Mercer SmartPath members enjoyed returns ranging from 5.6% to 8.6% p.a.2

Mercer Super Trust’s analysis of Mercer SmartPath (born 1984-1988), after investment fees and taxes. Past performance should not be relied upon as an indicator of future performance.

How has my super performed?

The majority of our Mercer Super members are invested in the Mercer SmartPath® investment option. You can see how each path has performed, over both the short and long term, from the table below (as at 31 December 2025).3

Mercer SmartPath® Ready-Made Investment Option

| Total returns (%) - after fees and taxes |

1 month | 3 months | 1 year | 3 years (p.a.) | 5 years (p.a.) | 7 years (p.a.) | 10 years (p.a.) |

| Born prior to 1929 |

0.2% | 0.9% | 7.7% | 8.3% | 5.7% | 6.1% | 5.6% |

| Born 1929 to 1933 | 0.2% | 0.9% | 7.9% | 8.7% | 6.1% | 6.5% | 5.8% |

| Born 1934 to 1938 | 0.2% | 0.9% | 7.8% | 8.5% | 5.9% | 6.3% | 5.7% |

| Born 1939 to 1943 | 0.2% | 0.8% | 7.4% | 8.5% | 5.9% | 6.2% | 5.7% |

| Born 1944 to 1948 | 0.2% | 0.8% | 7.4% | 8.4% | 5.8% | 6.2% | 5.7% |

| Born 1949 to 1953 | 0.2% | 0.9% | 7.2% | 8.6% | 6.0% | 6.3% | 5.8% |

| Born 1954 to 1958 | 0.2% | 0.9% | 7.4% | 8.6% | 6.4% | 6.9% | 6.4% |

| Born 1959 to 1963 | 0.2% | 0.9% | 8.4% | 9.8% | 7.4% | 7.8% | 7.1% |

| Born 1964 to 1968 | 0.2% | 0.8% | 9.5% | 10.9% | 8.4% | 8.9% | 8.0% |

| Born 1969 to 1973 | 0.3% | 0.9% | 10.5% | 12.0% | 9.2% | 9.6% | 8.6% |

| Born 1974 to 1978 | 0.3% | 0.9% | 10.6% | 12.1% | 9.2% | 9.7% | 8.6% |

| Born 1979 to 1983 | 0.3% | 0.9% | 10.1% | 12.1% | 9.2% | 9.7% | 8.6% |

| Born 1984 to 1988 | 0.3% | 0.9% | 9.9% | 12.1% | 9.2% | 9.7% | 8.6% |

| Born 1989 to 1993 | 0.3% | 0.9% | 10.3% | 12.1% | 9.2% | 9.6% | 8.5% |

| Born 1994 to 1998 | 0.3% | 0.8% | 10.5% | 12.0% | 9.1% | 9.6% | 8.5% |

| Born 1999 to 2003 | 0.3% | 0.9% | 10.7% | 12.0% | 9.0% | 9.5% | 8.4% |

| Born 2004 to 2008 | 0.3% | 0.8% | 10.2% | 11.9% | 8.8% | n/a | n/a |

| Born 2009 to 2013 | 0.3% | 0.7% | 10.3% | 12.0% | n/a | n/a | n/a |

| Born 2014 to 2018 | 0.4% | 1.0% | 10.3% | n/a | n/a | n/a | n/a |

Total Returns are based on exit prices and allow for deduction of tax and investment fees including indirect costs (but not administration or other fees). Returns greater than one year are shown on an annualised basis.

You can find historical performance information for all our other investment options on our Mercer Super Trust’s performance reports page.

Of course, it’s important to note that past performance is not an indicator of future performance. What strong long-term investment returns may reflect, however, is a superannuation fund’s experience and commitment to great financial outcomes for its members.

Want more detail on your fund’s historical performance?

Find out more about how your super is performing on our Mercer Super Trust’s performance reports page where you can:

- review our Monthly Mercer Super Trust performance reports

- review our Quarterly Mercer Super Trust performance reports

- access our daily Unit Price calculator

- read more about what to consider when comparing superannuation funds’ performance

Compare us with other super funds

Compare our investment returns, fees, insurance offer and member services with over 200 other funds through AppleCheck** – a free super comparison tool managed by leading research firm Chant West.

Member forms and documents

Find forms and documents to help manage your super.

Understanding fees and costs

All super funds charge fees to cover various costs related to your super account. At Mercer Super we’re committed to helping our members keep more of their money where it belongs – in their super account.

Investments performance reports

Access a range of reports and resources which provide detail on how the investment options in our products have performed over the short and long term.

Join Mercer Super today

Become a member and join more than 1 million other Australians already enjoying the benefits Mercer Super offers

Past performance is not a reliable indicator of future performance. The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

1 Generally, trustee-directed products are a type of superannuation investment option (or product) with a strategic asset allocation to more than one type of asset class. The investment strategy for these products is designed or managed by the superannuation trustee or its related entity.

2 Based on all Mercer SmartPath Corporate Super Division cohorts (with the exception of cohorts Born 2004-2008, Born 2009-2013 and Born 2014-2018 which have insufficient performance history to complete an assessment over all time periods) for members invested for the entire corresponding time period. Mercer Super Trust analysis of Mercer SmartPath performance (after investment fees and taxes) as at 31 December 2025.

3 Returns are for the Mercer SmartPath investment option in the Mercer Super Trust Corporate Super Division as at 31 December 2025.

- Past performance is not a reliable indicator of future performance.

- Differences between returns for each path can reflect different underlying investment strategies, or where strategies are the same, the timing of cash flows in the establishment of Mercer SmartPath.

- n/a indicates that the investment option was not operating for the full period.

- More information on the asset allocation and investment risks of each Mercer SmartPath cohort can be found in the relevant PDS available at mercersuper.com.au/pds.

Where consent has been given, Chant West may provide Mercer Super with a copy of the personal information that you enter to access AppleCheck. Mercer Super may use this information in accordance with our Privacy Policy to contact you and provide further details about the products and services we offer.

** By clicking the ‘Compare us’ button you will be linked to the Chant West website. Mercer Superannuation (Australia) Limited, ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust (‘Mercer Super’) ABN 19 905 422 981 takes no responsibility for the content of the website. Chant West AppleCheck is provided solely by Zenith CW Pty Ltd (Chant West) ABN 20 639 121 403. When using AppleCheck through this webpage, the default super fund division you will be comparing against is Mercer SmartSuper. You are able to compare against more than 200 super funds, including Mercer Super’s other fund divisions which are Mercer Business Super, Mercer SmartSuper Plan – Employer Default, and Mercer SmartSuper Plan – Individual Section. If you are a Mercer Super member and don’t know the name of your fund division, you can find out the name by logging in to the member portal. If you are a member of a tailored employer plan with Mercer Super then the fees and performance numbers on AppleCheck might not reflect the actual fees and performance numbers of your tailored plan, as you might already benefit from discounts your employer has negotiated with us. Past performance is not a reliable indicator of future performance.

Ratings are likely to change and are only one factor to be taken into account when deciding to invest in a product.

Issued by Mercer Superannuation (Australia) Limited (MSAL) ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’).

Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice we recommend you obtain your own financial advice and consider the Product Disclosure Statement and Financial Services Guide available at mercersuper.com.au. The product’s Target Market Determination setting out the class of people for whom the product may be suitable can be found at mercersuper.com.au/tmd.

The trustee has appointed Mercer Investments (Australia) Limited (MIAL) ABN 66 008 612 397 AFSL #244385 as an implemented consultant to provide investment strategy advice, portfolio management and implementation services including investment manager selection and monitoring. MIAL is also the responsible entity of a number of investment funds (the Mercer Funds). Mercer Super Trust invests in the Mercer Funds. Neither MSAL or MIAL or any of the underlying fund investment managers guarantee the investment performance, earnings or return of capital invested in any of the Mercer Super Trust investment options.

Mercer Financial Advisers are authorised representatives of Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766. The trustee has appointed MFAAPL to provide financial advice services for members of the Mercer Super Trust.

This information is based on information received in good faith from sources we believe to be reliable and accurate. Any reference to legislation reflects our understanding of the legislation and is not a substitute for legal advice. Before making any decision concerning the impact and application of laws to your circumstances, we recommend you obtain your own legal or other appropriate professional advice. No warranty as to the accuracy or completeness of this information is given and no responsibility is accepted by Mercer or any of its related entities for any loss or damage arising from any reliance on the information.

‘MERCER’ and ‘Mercer SmartPath®’ are Australian registered trademarks of Mercer (Australia) Pty Ltd ABN 32 005 315 917. ©2025 Mercer. All rights reserved.

Please also read and note the Care and Living with Mercer Terms of Use when accessing, browsing or using the services made available to you. 'MERCER' is a registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.