Compare your super

See how Mercer Super’s fees, fund performance and benefits to members compare.

How does Mercer Super stack up?

Backed by 75 years of global investment expertise, a history of strong returns,† and low administration fees,†† Mercer Super is supporting more than 1 million members step into their financial future with confidence.

Focused on long-term returns

At Mercer Super, we’re focused on delivering strong, long-term returns for our members. Our local know-how and global expertise are put to work for you, with 3,000 investment professionals in 42 markets, seeking out opportunities in Australia and around the world.

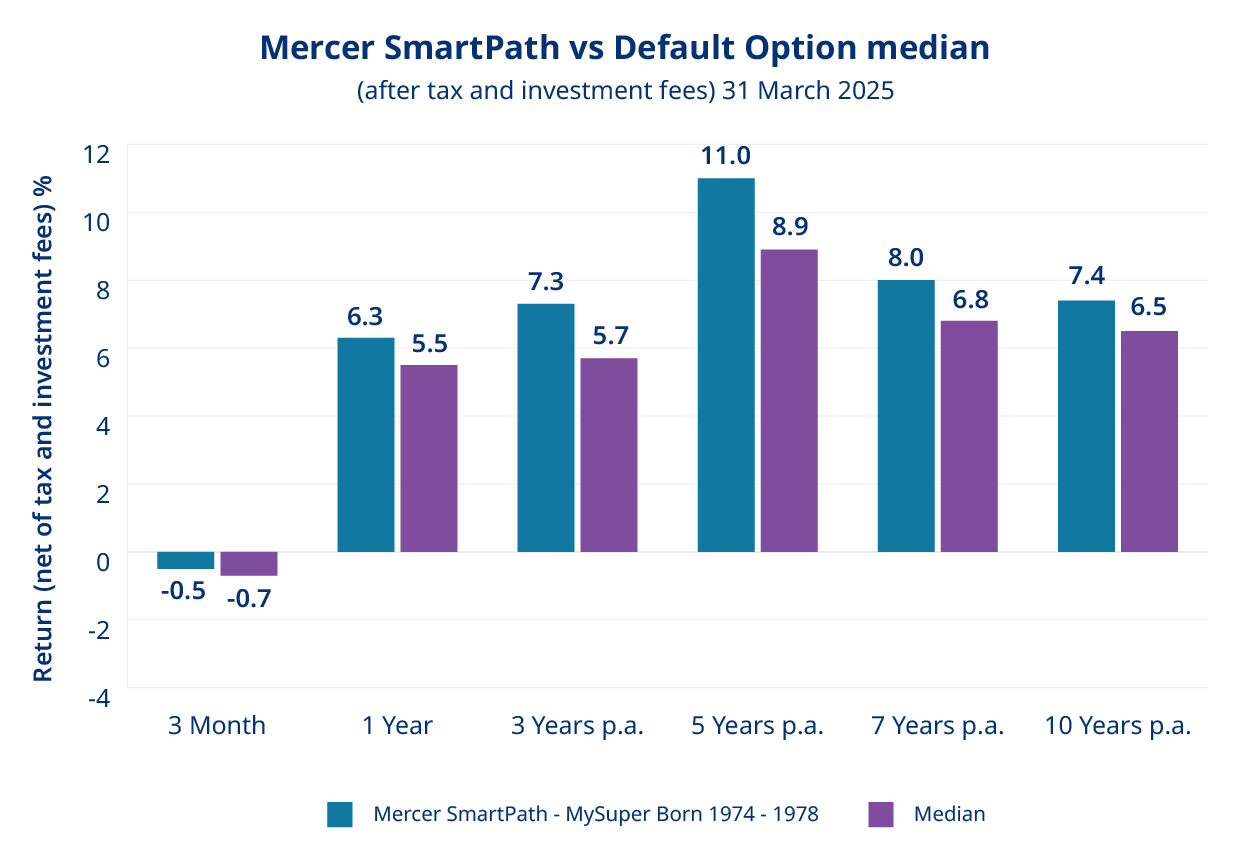

Over the longer term, Mercer SmartPath® has delivered on average 7.4% p.a. over 10 years for one of our largest groups of members, outperforming the comparative industry median of 6.5% p.a.†

Mercer SmartPath vs Default Options median

(after tax and investment fees) as at 31 March 2025

Mercer Super Trust’s analysis of Mercer SmartPath (Born 1974-1978), compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2025. Past performance should not be relied upon as an indicator of future performance.

Low admin fees††, means more money in your super

At Mercer Super, we understand the importance of minimising costs and maximising returns. That's why our MySuper SmartPath® standard admin fees are between 16% and 36% below the MySuper market average, depending on your account balance.††

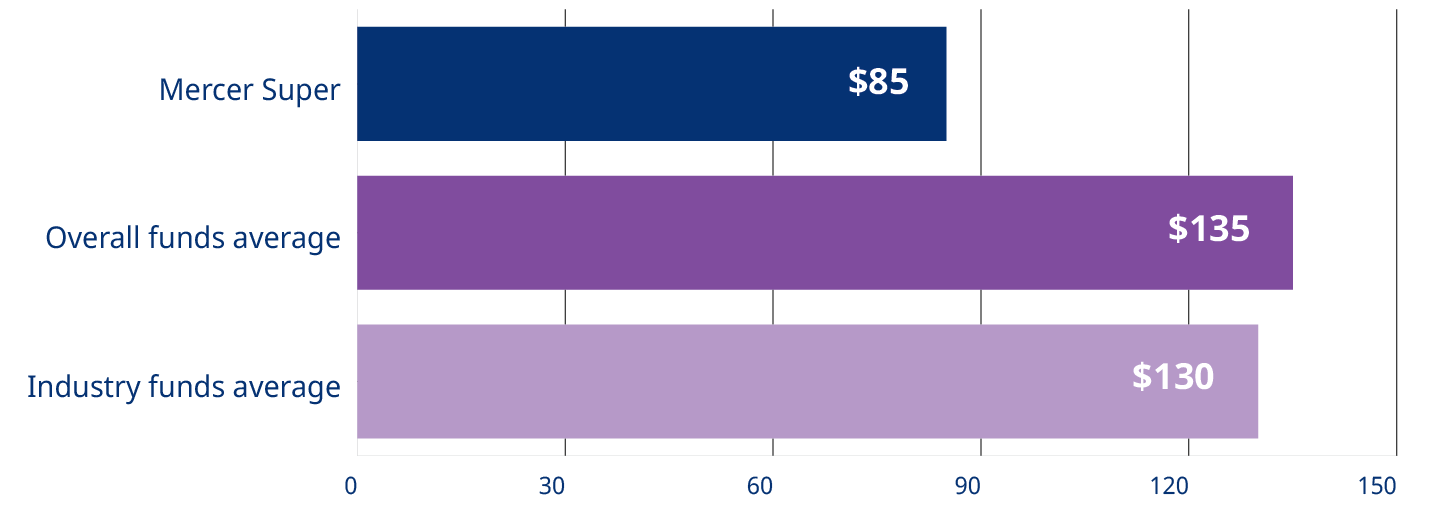

Annual administration fee on $50,000 account balance

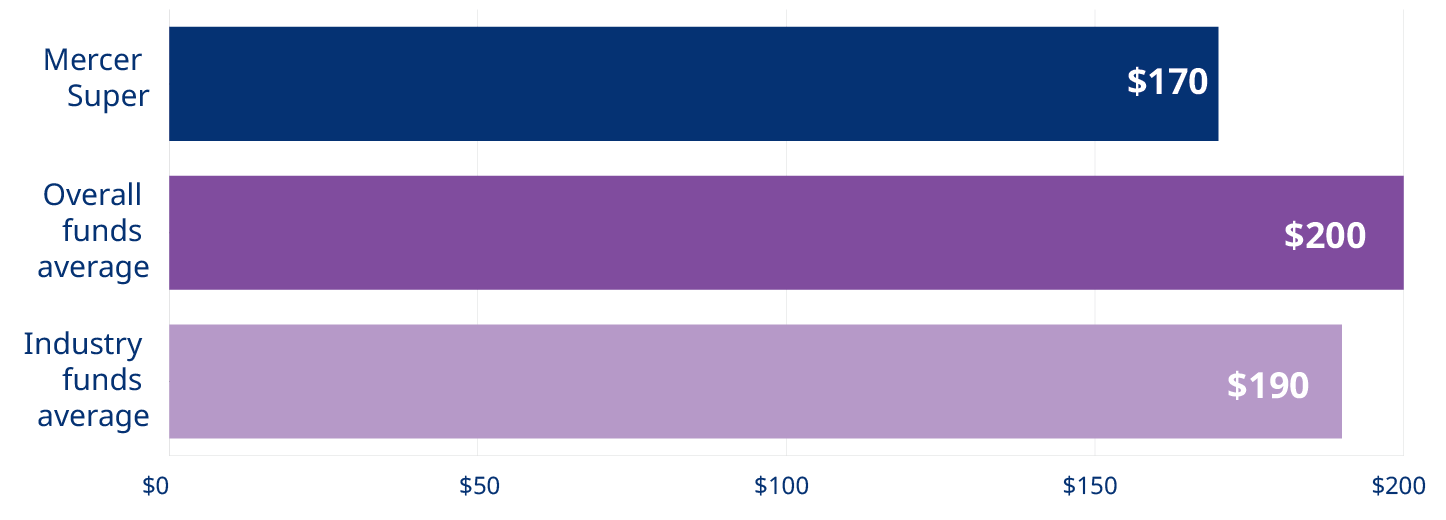

Annual administration fee on $100,000 account balance

†† ChantWest MySuper Default Fee Tables March 2025 – for $50,000 and $100,000 account balances. Fees are for Mercer SmartSuper - SmartPath® (our MySuper product) as at 31 March 2025 for total administration fees and costs. Chant West uses our 1964-1968 investment option for purposes of comparison with other MySuper funds. You may pay less than this if you are in an employer plan with discounted fees. For more details on fees for each of our SmartPath options, or if you’ve chosen your own investment option/s, go to the ‘How Your Super Works' guide online. Fees and costs can vary from year to year. Past fees and costs are not a reliable indicator of future fees and costs. Fees and comparisons may differ for other investment options and account balances.

Compare us with other super funds

Compare our investment returns, fees, insurance offer and member services with over 200 other funds through AppleCheck** – a free super comparison tool managed by leading research firm Chant West.

More ways to support you

Mercer Super offers members the opportunity to become more secure and confident in their financial life journey. Explore the ways we’re here to support you and your loved ones.

Financial advice

Access a range of financial advice support tools and services to help make the decisions that will work best for you.

Ageing care

Care & Living with Mercer helps members, and their loved ones, navigate ageing care with confidence.

Insurance

As a member, you have access to insurance in your super to help ensure financial security for you and your loved ones.

Join Mercer Super today!

Become a Mercer Super member and join 1 million plus other Australians enjoying the benefits Mercer Super offers

Past performance is not a reliable indicator of future performance. The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

† Mercer Super’s default investment option Mercer SmartPath®, has delivered on average 7.4% p.a. over 10 years for one of our largest groups of members, outperforming the comparative industry median of 6.5% p.a. Based on Mercer SmartPath membership data as at 31 March 2025 and for members invested for the full period. Mercer Super Trust’s analysis of Mercer SmartPath (born 1974-1978), one of the largest cohorts, after investment fees and tax, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2025. Past performance is not a reliable indicator of future performance.

†† ChantWest MySuper Default Fee Tables March 2025 – for $50,000 and $100,000 account balances. Fees are for Mercer SmartSuper - SmartPath® (our MySuper product) as at 31 March 2025 for total administration fees and costs. Chant West uses our 1964-1968 investment option for purposes of comparison with other MySuper funds. You may pay less than this if you are in an employer plan with discounted fees. For more details on fees for each of our SmartPath options, or if you’ve chosen your own investment option/s, go to the ‘How Your Super Works' guide online. Fees and costs can vary from year to year. Past fees and costs are not a reliable indicator of future fees and costs. Fees and comparisons may differ for other investment options and account balances.

** By clicking the ‘Compare us’ button you will be linked to the Chant West website. Mercer Superannuation (Australia) Limited, ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust (‘Mercer Super’) ABN 19 905 422 981 takes no responsibility for the content of the website. Chant West AppleCheck is provided solely by Zenith CW Pty Ltd (Chant West) ABN 20 639 121 403. When using AppleCheck through this webpage, the default super fund division you will be comparing against is Mercer SmartSuper. You are able to compare against more than 200 super funds, including Mercer Super’s other fund divisions which are Mercer Business Super, Mercer Portfolio Service, Mercer SmartSuper Plan – Employer Default, and Mercer SmartSuper Plan – Individual Section. If you are a Mercer Super member and don’t know the name of your fund division, you can find out the name by logging on to Member Online. If you are a member of a tailored employer plan with Mercer Super then the fees and performance numbers on AppleCheck might not reflect the actual fees and performance numbers of your tailored plan, as you might already benefit from discounts your employer has negotiated with us. Past performance is not a reliable indicator of future performance.

* Mercer Super has been recognised with several SuperRatings awards, including SuperRatings' highest platinum rating for both our Allocated Pension Division (now known as Mercer SmartRetirement Income) and Corporate Superannuation Division products. Mercer SmartRetirement Income and the Corporate Superannuation Division products also received SuperRatings Platinum Performance awards, based on investment returns, fees, insurance, member servicing, administration and governance for 10 and 15 years respectively. Ratings issued by SuperRatings Pty Ltd a Corporate Authorised Representative (CAR No.1309956) of Lonsec Research Pty Ltd AFSL No. 421445 are general advice only. Rating is not a recommendation to purchase, sell or hold any product and subject to change without notice. SuperRatings may receive a fee for the use of its ratings and awards. Visit SuperRatings.com.au for ratings information.

Mercer Super has been recognised with several Chant West Apple Ratings for 2025, including 5 Apples - Highest Quality Fund rating for Mercer Super's super products Mercer SmartSuper Plan - Employer, Mercer SmartSuper Plan - Individual, Mercer SmartSuper and Mercer Business Super, as well as Mercer Super's pension product Mercer SmartRetirement Income. The Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West rating (assigned February 2025) is limited to General Advice only and has been prepared without considering your objectives or financial situation, including target markets where applicable. The rating is not a recommendation to purchase, sell or hold any product and is subject to change at any time without notice. You should seek independent advice and consider the PDS or offer document before making any investment decisions. Ratings have been assigned based on third party data. Liability is not accepted, whether direct or indirect, from use of the rating. Refer to chantwest.com.au for full ratings information and their FSG.

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice, please consider the Product Disclosure Statement available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd.

Past performance is not a reliable indicator of future performance.

Ratings are likely to change and are only one factor to be taken into account when deciding to invest in a product.

The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

Please also read and note the Care and Living with Mercer Terms of Use when accessing, browsing or using the services made available to you.

'MERCER’ is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917. Copyright ©2024 Mercer. All rights reserved.