Submit an online support enquiry

Log in to your account for more information or to submit an online enquiry.

Need more help? We’ve got you covered.

Have questions about Mercer Super or need more information about becoming a member? We’d love to hear from you.

Contact us

General enquiries: 1800 682 525

Pension enquiries: 1800 671 369

Calling from overseas: +61 3 8306 0900

Monday - Friday, 8am to 7pm (AEST/AEDT)

Secure online form: Login to contact us

Address: GPO Box 4303 Melbourne VIC 3001

Fund details

Fund Name: Mercer Super Trust

ABN: 19 905 422 981

USI: You can find your Unique Superannuation Identifier (USI) at the bottom of the My Details page within the member portal.

Letter of Compliance / Choice of Fund:

- Log in to the member portal and access My details

- Note your plan name and USI

- Download the Choice of Fund form and fill in your details (the Letter of Compliance is on page 2)

Frequently Asked Questions (FAQs)

Below is a list of common questions you might have about your super account.

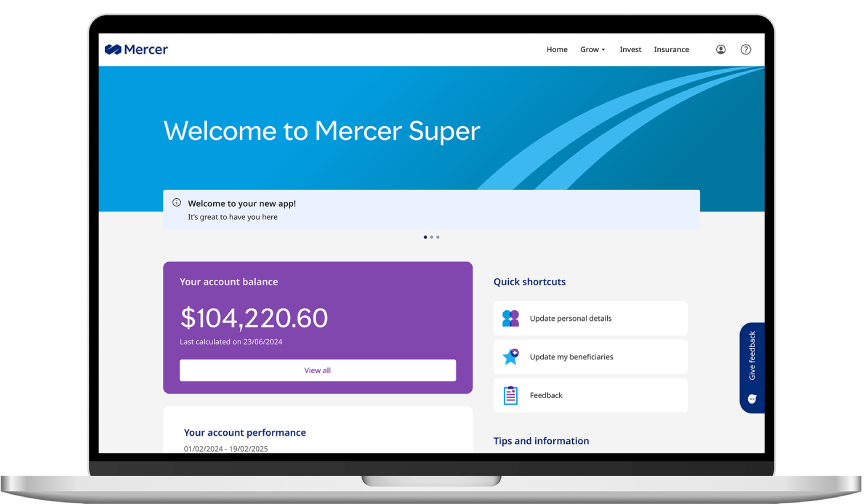

Member portal

Visit the member portal page for more information.

Beneficiary

Talk to an adviser

We value your feedback and we're here to help.

No matter your stage of life, the right advice at the right time can give you the confidence to take control of your financial future.

Make a complaint

We value your feedback and we're here to help.

If you have a problem or need to make a complaint, we have procedures in place to help put things right.

Issued by Mercer Superannuation (Australia) Limited (MSAL) ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’).

Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice we recommend you obtain your own financial advice and consider the Product Disclosure Statement available at mercersuper.com.au. The product’s Target Market Determination setting out the class of people for whom the product may be suitable can be found at mercersuper.com.au/tmd. ‘MERCER’ and Mercer SmartSuper® is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.