Inside your annual statement

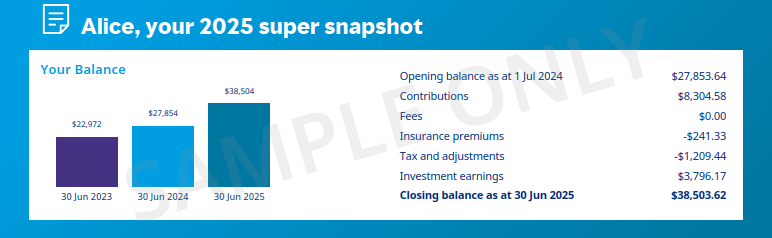

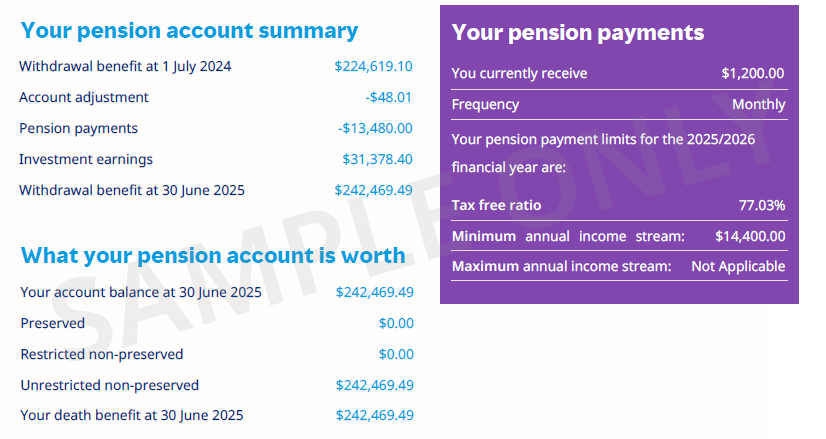

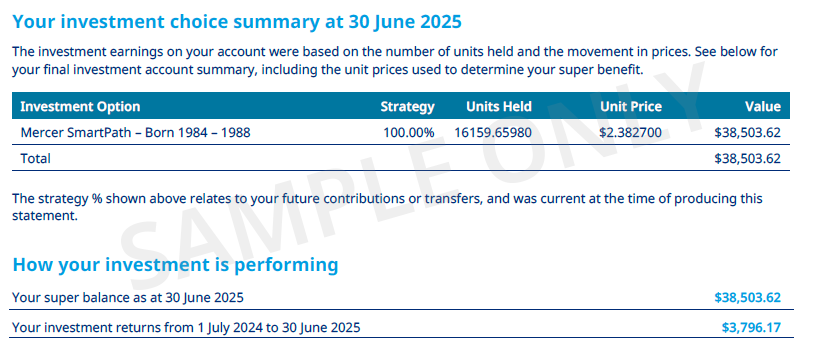

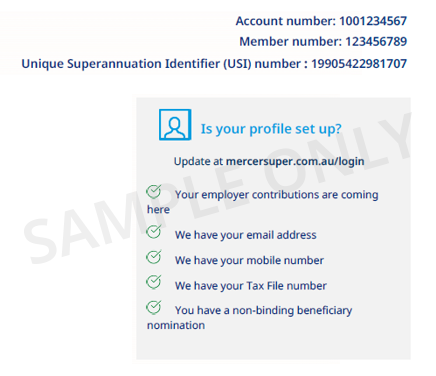

Your annual Mercer Super statement shows you how your super performed over the past financial year, but it’s more than that. It’s also filled with information that can help you make your super count.

When will you get your annual statement?

Most Mercer Super members will have received their annual statements by late November.

- Super statements will start being issued from early August.

- Pension statements will start being issued from mid-August.

Get the most out of your annual statement

To help secure your financial future, you can do a few simple things after receiving your annual statement.

Depending on your account type or when you joined Mercer Super, some of the example images shown below may not match your statement.

- Open all

- |

- Close all

Frequently Asked Questions

General

- Open all

- |

- Close all

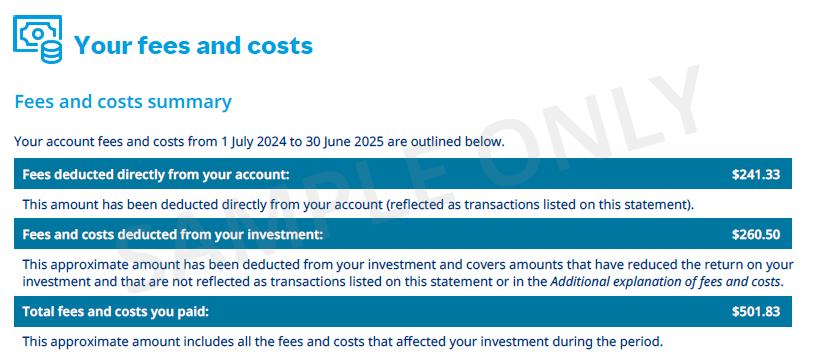

Fees

- Open all

- |

- Close all

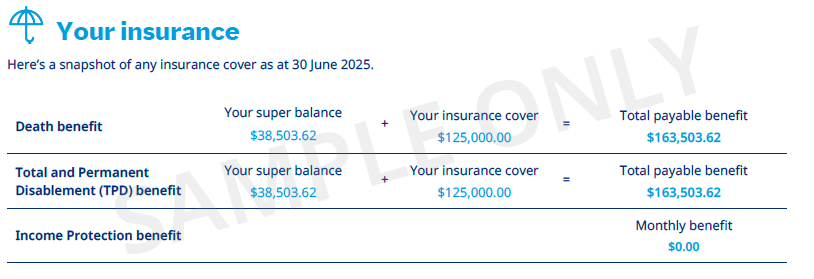

Insurance

- Open all

- |

- Close all

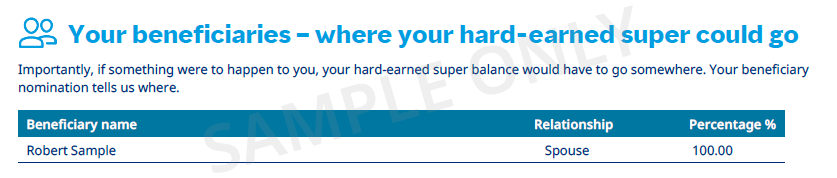

Beneficiaries

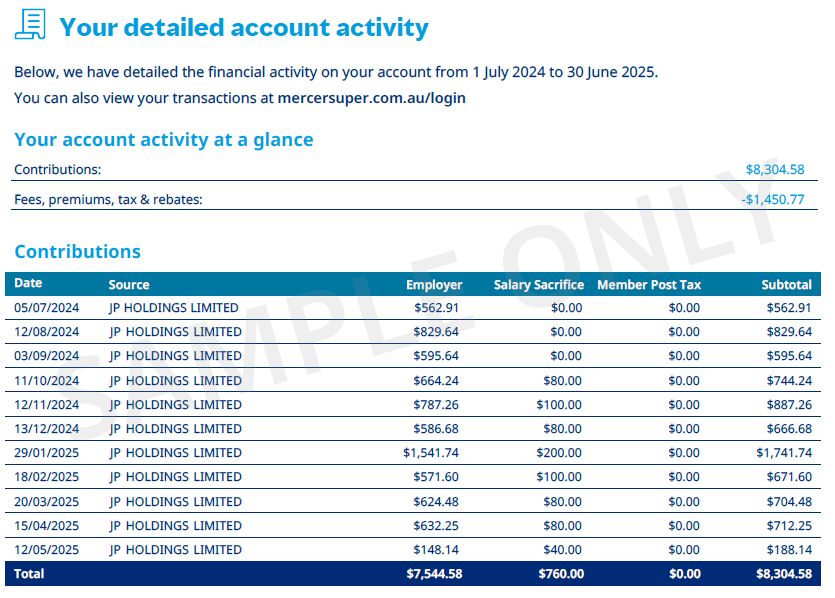

Contributions

- Open all

- |

- Close all

Pension payments

Financial advice

Need more help? We’ve got you covered.

Have questions about Mercer Super or need more information about becoming a member? We’d love to hear from you.

Member portal support

Log in to your account for more information or to submit an online enquiry.

Contact our Helpline

Visit the member support page or call 1800 682 525, Monday to Friday, 8am-7pm (AEST/ AEDT).

1 As a Mercer Super Trust member, you have access to limited financial advice at no extra cost. The trustee has appointed Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence 411766 to provide financial advice services for members of the Mercer Super Trust. MFAPPL also provides comprehensive tailored advice at an additional cost.

Issued by Mercer Superannuation (Australia) Limited (MSAL) ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’). Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice we recommend you obtain your own financial advice and consider the Product Disclosure Statement and Financial Services Guide available at mercersuper.com.au/pds. The product’s Target Market Determination setting out the class of people for whom the product may be suitable can be found at mercersuper.com.au/tmd. The trustee has appointed Mercer Investments (Australia) Limited (MIAL) ABN 66 008 612 397 AFSL #244385 as an implemented consultant to provide investment strategy advice, portfolio management and implementation services including investment manager selection and monitoring. MIAL is also the responsible entity of a number of investment funds (the Mercer Funds). Mercer Super Trust invests in the Mercer Funds. Neither MSAL or MIAL or any of the underlying fund investment managers guarantee the investment performance, earnings or return of capital invested in any of the Mercer Super Trust investment options. Mercer Financial Advisers are authorised representatives of Mercer Financial Advice (Australia) Pty Ltd (MFAAPL) ABN 76 153 168 293, Australian Financial Services Licence #411766. The trustee has appointed MFAAPL to provide financial advice services for members of the Mercer Super Trust. ‘MERCER’ and ‘Mercer SmartPath®’ are Australian registered trademarks of Mercer (Australia) Pty Ltd ABN 32 005 315 917. ©2025 Mercer. All rights reserved.