April to June 2025

The second quarter of 2025 saw positive returns across both Mercer SmartPath1 and the Ready-made investment options1 as markets performed strongly following a weaker first quarter.2

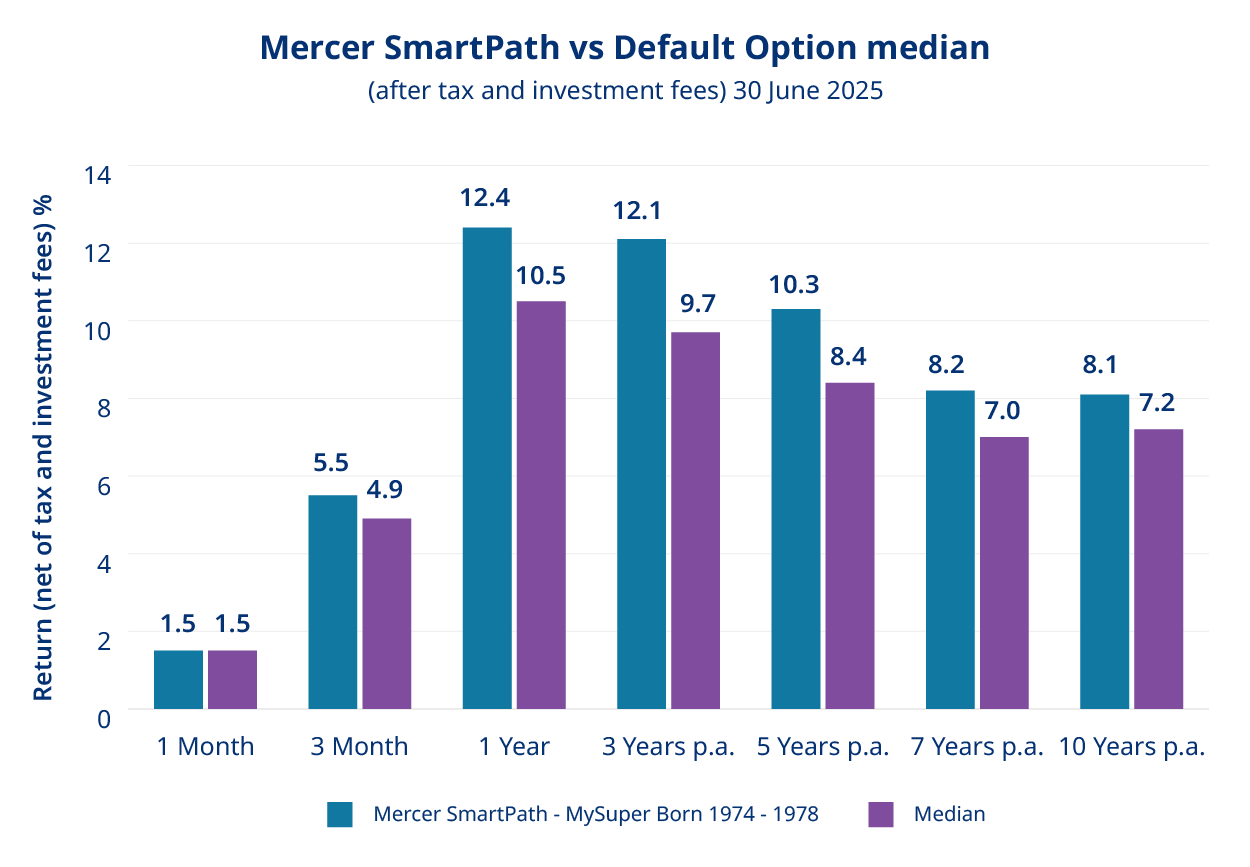

Mercer SmartPath Performance

Q2 2025

Our default investment option, Mercer SmartPath, delivered better than industry median returns, for all our Mercer SmartPath members aged 55 or under, for the quarter, with returns ranging between 5.4% and 5.6%.3

12 months

For the 12 months up to 30 June 2025, all Mercer SmartPath members aged 55 or under enjoyed returns in the top quartile of performance, ranging from 12.3% to 12.7%.3

Over the longer term

While over the longer term – where super is best measured – all Mercer SmartPath members aged 55 or under continued to enjoy returns well above the industry median over 1, 3, 5, 7 and 10-year time periods.3

Mercer Super Trust’s analysis of Mercer SmartPath (born 1974-1978), compared to the median of all default funds reported in the SuperRatings Fund Crediting Rate Survey – Default Options as at 30 June 2025. Past performance should not be relied upon as an indicator of future performance.

Ready-made diversified investment options

Q2 2025

Our Ready-made diversified choice options delivered positive performance in Q2, with returns ranging from 2.5% to 5.4%.4

The best performing options were those with a higher exposure to shares, such as Mercer High Growth.4

12 months

For the 12 months to 30 June 2025, all options performed either equal to, or above, their respective peer group median, except for the Mercer Select Growth option. Returns ranged between 7.8% for Mercer Conservative Growth, and 12.2% for Mercer High Growth. 4

Over the longer term

Over the longer term, nearly all our Ready-made diversified options continued to perform at or above their respective peer group medians over 3, 5, 7 and 10 years.4

Explore our new fresh look report

Easily find out how your investment options performed and get market insights from our investment experts.

You're in capable hands

The Mercer Investments team operates in over 30 countries and includes more than 3,000 professionals, with over 300 based in Australia. Our local and global teams collaborate closely to monitor the markets and build portfolios aimed at driving performance while implementing robust due diligence and active risk management.

Important principles we follow:

Diversification

Investing in a diverse range of assets, geographies and sectors seeking to reduce the overall impact of high volatility in other assets. Much like the saying 'don’t put all your eggs in one basket.'

Investment Strategy

We take a thoughtful and adaptable approach to investing. This means assets are chosen based on careful planning, and we’re ready to adjust our strategy as market conditions change.

Modelling

Implementing robust risk management practices that consider a variety of possible market outcomes, and how best to prepare for them and to respond should they occur.

Read next:

Market volatility and your super

As a superannuation member, your super balance is typically invested in various asset classes and financial markets - and volatility is unavoidable. So don't be alarmed when your balance dips from time to time.

Investment risk and your super

Risk is something many of us naturally avoid, especially when it comes to our personal well-being or our finances. Reward on the other hand, is a word that draws us in. When it comes to investing, risk and rewards are intrinsically linked.

Diversification and your super

We all know the phrase "don't put all your eggs in one basket". If you drop your only basket, you break all your eggs. But if you have many baskets and you drop one, you have eggs to spare. That's diversification in a nutshell.

**Past performance is not a reliable indicator of future performance. The value of an investment in Mercer Super may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

1. Mercer Super Trust analysis of the performance (after investment fees and taxes) for the Mercer SmartPath and Ready-made options in the Corporate Super Division for the April 2025 to June 2025 quarter.

2. Mercer Super Trust’s analysis of financial market asset class returns and economic insights.

3. Based on all Mercer SmartPath Corporate Super Division cohorts with members aged 55 or under (with the exception of cohorts Born 2004-2008, Born 2009-2013 and Born 2014-2018 which have insufficient performance history to complete an assessment over all time periods) for members invested for the entire corresponding time period. Mercer Super Trust analysis of Mercer SmartPath performance (after investment fees and taxes) as at 30 June 2025 compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 30 June 2025.

4. Mercer Super Trust’s analysis of Mercer Super’s Ready-made diversified investment options in the Corporate Super Division, compared to its respective growth asset ratio fund survey’s median as reported in SuperRatings Fund Crediting Rate Survey as at 30 June 2025. The Mercer Select Growth investment option has not yet reached 10 years since inception.

Issued by Mercer Superannuation (Australia) Limited (MSAL) ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’).

Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice we recommend you obtain your own financial advice and consider the Product Disclosure Statement and Financial Services Guide available at mercersuper.com.au. The product’s Target Market Determination setting out the class of people for whom the product may be suitable can be found at mercersuper.com.au/tmd.

Ratings are likely to change and are only one factor to be taken into account when deciding to invest in a product.

The trustee has appointed Mercer Investments (Australia) Limited (MIAL) ABN 66 008 612 397 AFSL #244385 as an implemented consultant to provide investment strategy advice, portfolio management and implementation services including investment manager selection and monitoring. MIAL is also the responsible entity of a number of investment funds (the Mercer Funds). Mercer Super Trust invests in the Mercer Funds. Neither MSAL or MIAL or any of the underlying fund investment managers guarantee the investment performance, earnings or return of capital invested in any of the Mercer Super Trust investment options.

‘MERCER’ and ‘Mercer SmartPath®’ are Australian registered trademarks of Mercer (Australia) Pty Ltd ABN 32 005 315 917. ©2025 Mercer. All rights reserved.