We’ve all heard the phrase “don’t put all your eggs in one basket” and we all understand its meaning: if you drop your one and only basket, you break all your eggs, all at once. But if you have many baskets and you drop one, you have eggs to spare. That’s diversification in a nutshell: more baskets = less chance of losing all your eggs in a single stroke.

Diversity reduces risk

The idea applies perfectly to investing – by spreading your investments (your eggs) across a range of different investment types (your baskets), you minimise the chance of losing everything in one go. If one company or industry falls in value others may rise, lowering your overall risk of large short-term losses.

Diversification helps to ensure your overall portfolio can weather unexpected shifts in the economic environment because different investment types – called asset classes – are very likely to respond differently to a given economic event.

How diversification applies to your super

Most Mercer Super members are invested in a diversified “Ready-made” investment option. There are many ways to diversify a portfolio and our investment experts put them all to work on your behalf. Some of the ways diversification is achieved are below:

- Asset Classes - growth vs defensive

- Geography

- Industries and Sectors

- Company size

These can be applied to shares, fixed-interest and other asset classes.

Asset Classes - growth vs defensive

Most asset classes can be characterized very broadly as growth assets and defensive assets.

Mercer Super Ready-made investment options include a range of growth assets like Australian and international shares, as well as defensive assets like fixed interest and cash.

Balancing an investment portfolio more toward growth assets increases its long-term earning potential, but also increases the risk of short-term losses. Defensive assets are less volatile over the short-term, but long-term growth is generally more subdued.

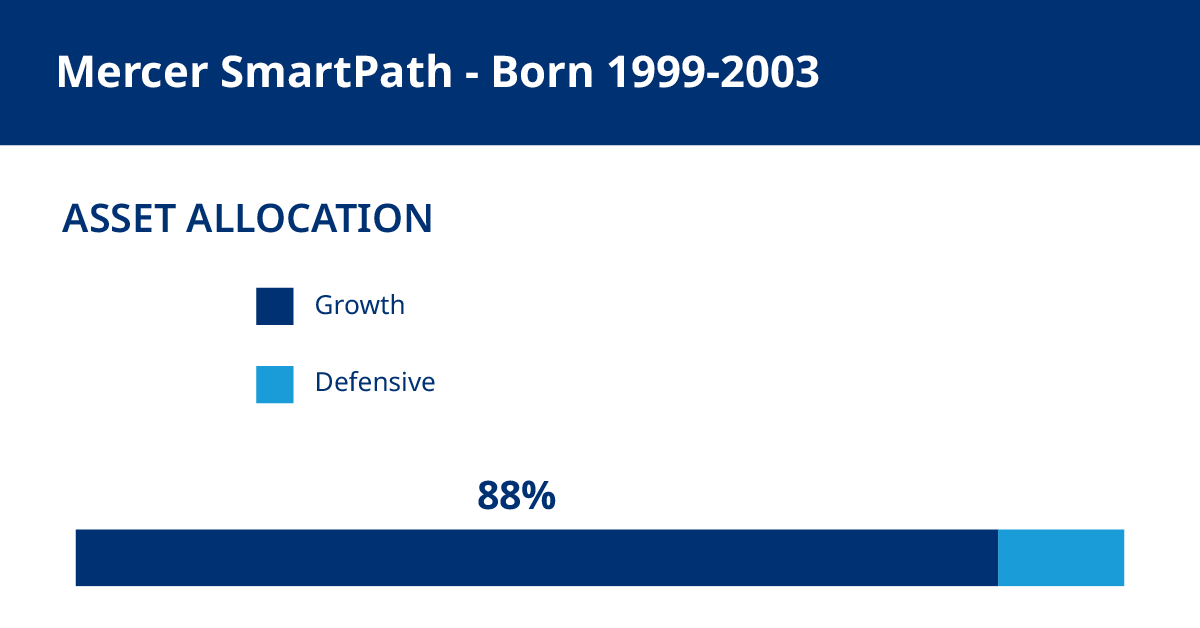

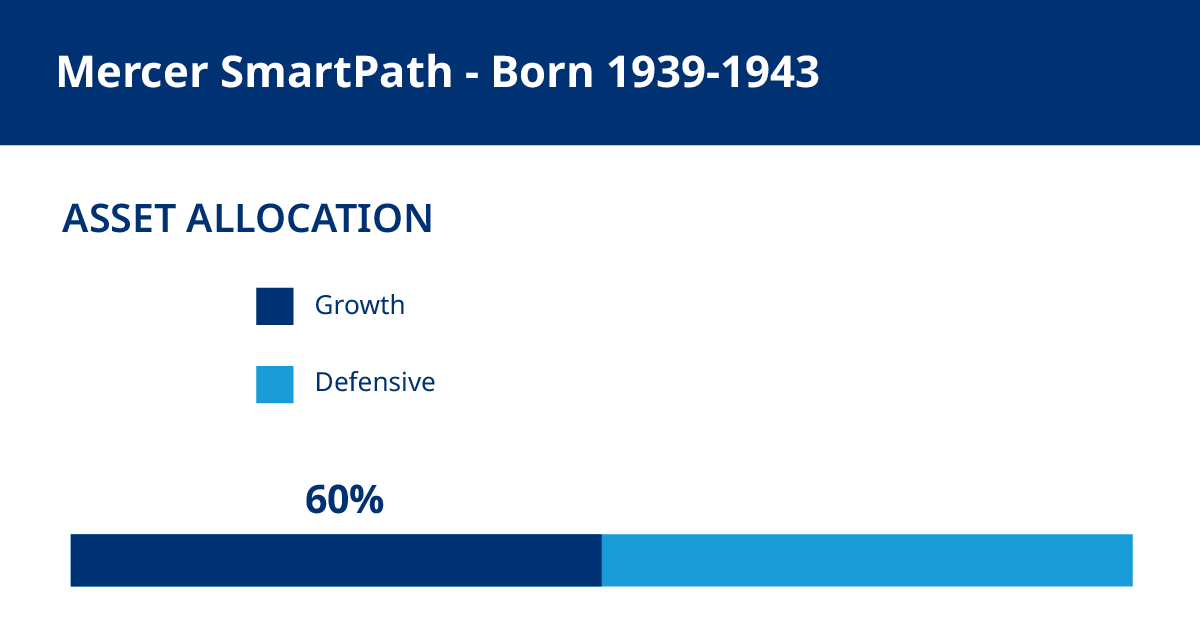

Younger members invested in Mercer SmartPath, for example, will have a high allocation to growth assets to take advantage of the long-term earning potential.

Older members invested in Mercer SmartPath will have a more defensive asset allocation, to help protect their account balance in the years leading up to and after retirement.

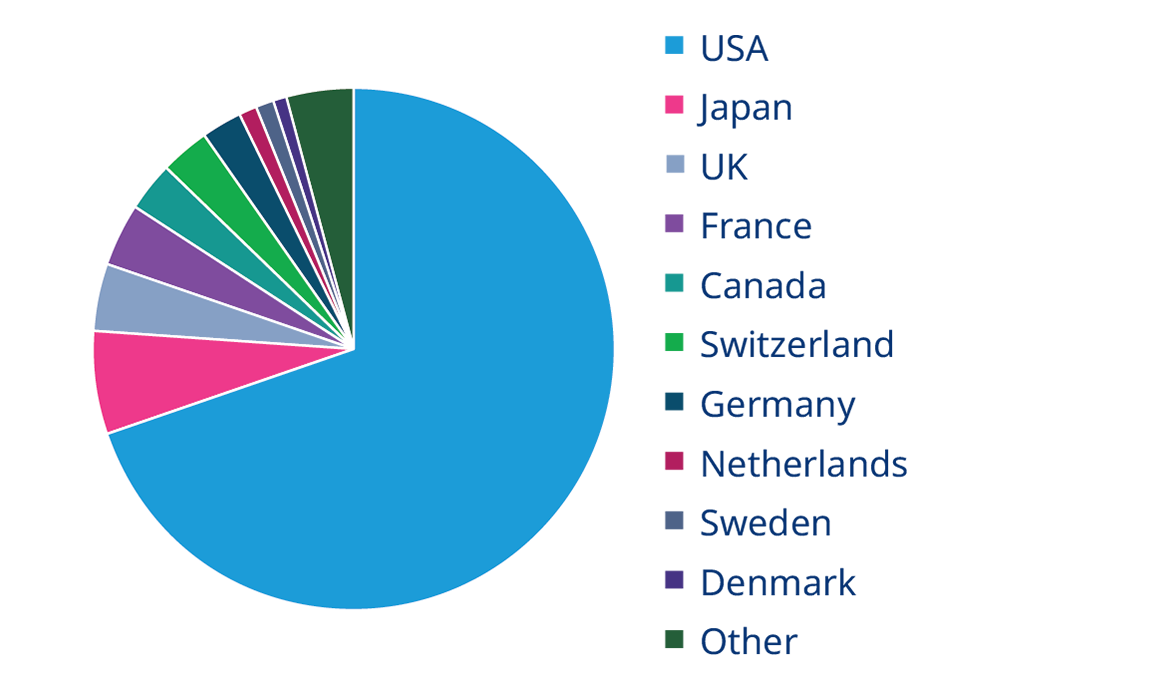

Geography

The location of a company can also be an element of diversification, because financial markets in different parts of the world may behave differently from one another at any given time.

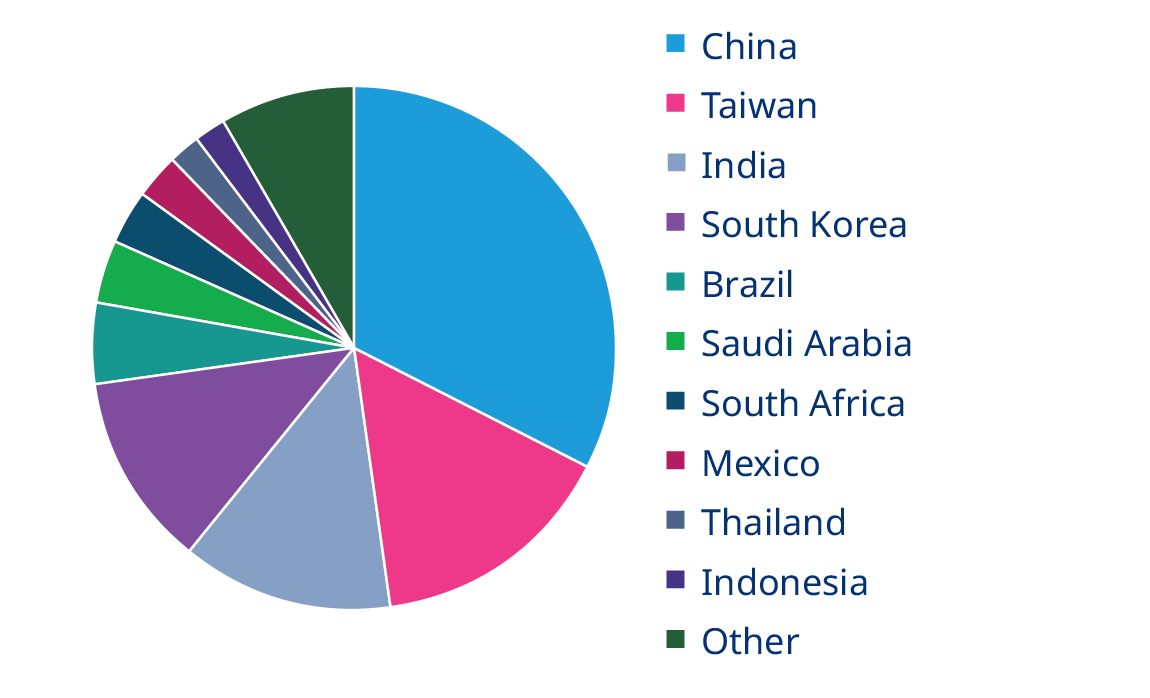

For example, if developed countries’ stock markets are declining due to local economic factors, an investor may diversify their portfolio by investing in emerging economies with higher growth rates.

Mercer Super Ready-made options are diversified by geography, with exposure to companies in many countries in developed and emerging economies.

Ready-made options' allocations

to International Shares

Ready-made options' allocations

to Emerging Market Shares

The allocations shown are for illustration purposes only and are based on the Mercer SmartPath investment option (August 2023). Allocations may vary between individual Ready-made investment options.

Industries and sectors

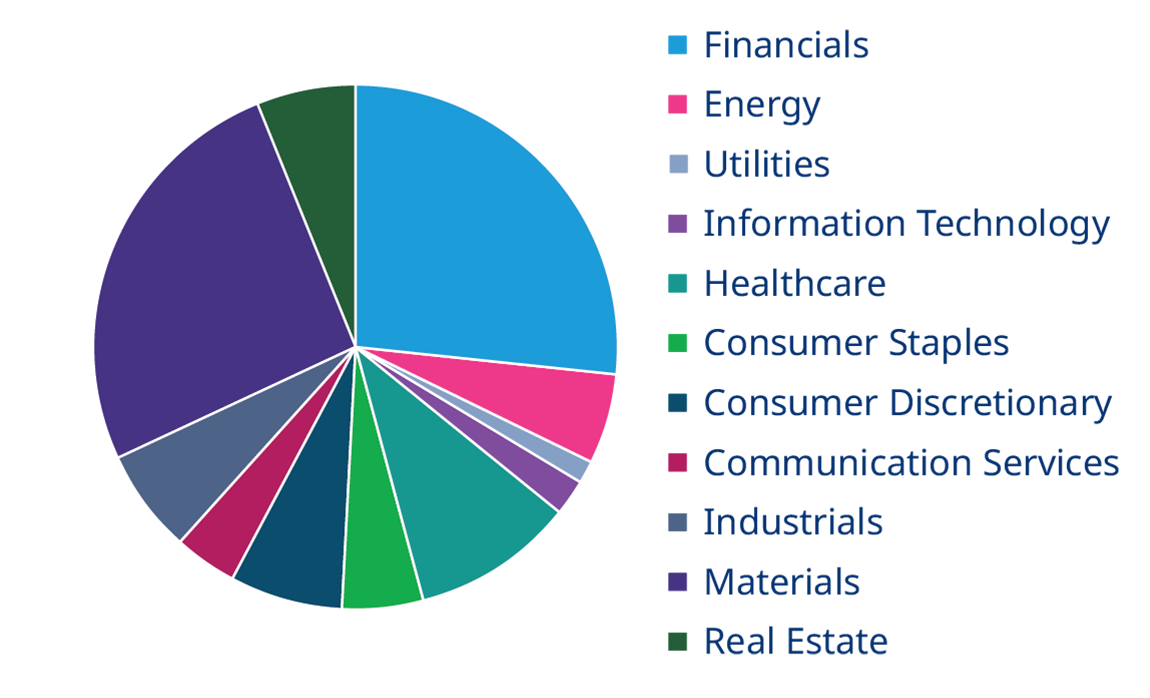

Investing in companies from different industries is another example of diversification because the impact of economic events and conditions will vary from industry to industry. For example, commercial real estate was hit hard during the early stages of the Covid-19 pandemic, but information technology shares performed well.

Mercer Super Ready-made investment options include shares in Australian and international companies from many sectors of the economy, including financial services, information technology, utilities, health care and real estate.

The allocations shown are for illustration purposes only and are based on the Mercer SmartPath investment option (August 2023). Allocations may vary between individual Ready-made investment options.

Company size

The size of a company (as measured by market value) is another source of diversification. Generally speaking, small-cap companies (with a market value of between $300 million and $2 billion) have higher risks and higher returns than more stable, large-cap companies (those with a market value of $10 billion plus).

A diversified portfolio might include a mix of large, stable corporations and smaller companies with growth potential. Mercer Super Ready-made options include just such a mix, with allocations1 to household names like BHP, NAB and Woolworths and some exposure to smaller companies.

All investments carry some risk

Investing comes with inherent risks, and these risks can never be completely eliminated. Diversification is simply a strategy to help limit exposure to certain investment risks, and reduce the risk of large short-term losses. While it might help improve your returns over time, diversification doesn’t guarantee a positive return.

Your tolerance for risk, your personal goals and how long you will be invested, are all considerations when choosing your Mercer Super investment option. The e-Advice tool – available to Mercer Super members at no additional cost – offers personal advice on which of our many investment options best align with your specific risk profile, providing peace of mind as you plan your retirement.

Read next:

Understanding superannuation contributions and taxes

By adding a little bit extra to your super, you could enjoy more retirement savings and several tax benefits.

Nominating your superannuation beneficiary

By nominating a beneficiary you can let us know who you’d like your super to go if you pass away.

The ins and outs of additional personal super contributions

Your super is a long-term investment – additional contributions you make today can have a significant impact on your balance and retirement outcomes.

1. As of 31 March 2023

Disclaimer: Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). This information is general advice and does not take into account your objectives, financial situation or needs. Before acting on this advice, please consider the Product Disclosure Statement available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd.

The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

Past performance is not a reliable indicator of future performance.