Global markets experienced significant fluctuations in the first quarter of 2025, largely driven by geopolitical developments, including US tariff announcements.

To help smooth out returns and reduce the risk against sudden market changes, we diversify our investment options across different investment types, industries and countries.

Quarterly performance update

Hear from Graeme Miller, Mercer Super's CIO, as he provides an update on the quarterly performance for Q1 2025.

**Past performance is not a reliable indicator of future performance. The value of an investment in Mercer Super may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

January to March 2025

In the first quarter of 2025, some Mercer Super members experienced negative returns due to the market fluctuations. While these conditions were felt by the wider super industry, most Mercer SmartPath and Ready-made investment options outperformed their industry medians over the quarter, highlighting the effectiveness of our investment approach.1

Despite the negative returns over the quarter, returns over the last 1, 3, 5, 7 and 10 years remain positive for all of Mercer SmartPath® and Ready-made investment options.1

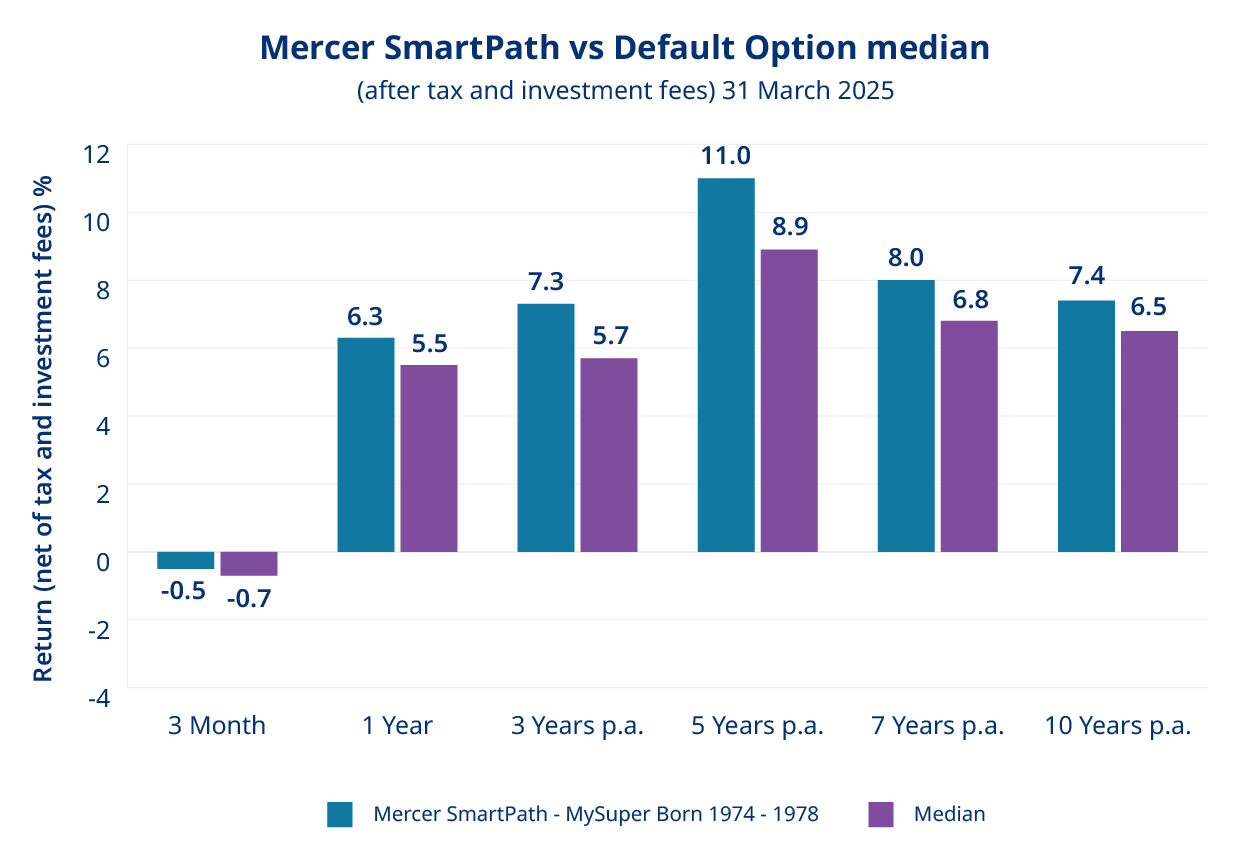

Mercer SmartPath® Performance

Q1 2025

Our default investment option, Mercer SmartPath, delivered better than industry median returns for nearly 70% of our Mercer SmartPath members for the quarter. Returns ranged between -1.2% and +0.3% for the quarter.2

12 months

For the 12 months up to 31 March 2025, nearly all Mercer SmartPath members enjoyed returns above the industry medians, ranging from +5.5% to +6.6%.2

Over the longer term

While over the longer term – where super is best measured – all Mercer SmartPath members under the age of 60 continue to enjoy returns well above the industry median over 1, 3, 5, 7 and 10-year time periods.3

Mercer Super Trust’s analysis of Mercer SmartPath (born 1974-1978), compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2025. Past performance should not be relied upon as an indicator of future performance.

Ready-made diversified investment options

Q1 2025

Market volatility during the quarter resulted in mixed performances for our Ready-made diversified choice options, with returns ranging from -1.7% to +0.7% for the quarter.4

The best performing options were those with a lower exposure to shares, being Mercer Conservative Growth and Mercer Moderate Growth.

12 months

For the 12 months to 31 March 2025, all options performed either equal to, or above, their respective peer group median, with the exception of the Mercer Diversified Shares option. Returns ranged between 5.1% for Mercer Conservative Growth, and 6.2% for Mercer Diversified Shares. 4

Over the longer term

Over the longer term, all Ready-made diversified options continued to perform above their respective peer group medians over 3, 5, 7 and 10 years.4

Economic and investment update5

Q1 2025 Investment market update

In the first quarter of 2025, share markets experienced a decline, with international shares down 2.6% due to concerns over US tariffs. This particularly affected major technology stocks known as the Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla).

In Australia, shares fell by 2.9%, primarily driven by weak performance in the technology and healthcare sectors.

Q1 2025 Economic market update

In February, the Reserve Bank of Australia (RBA) cut the cash rate to 4.10%, marking the first time it has cut rates since 2020. However, they cautioned that future cuts may be limited due to a tight job market.

Meanwhile, the US Federal Reserve maintained steady interest rates, with Governor Powell noting that while short-term inflation expectations have risen due to tariffs and uncertainty, long-term expectations remain stable.

Explore our new fresh look report

Easily find out how your investment options performed and get market insights from our investment experts.

You're in capable hands

The Mercer Investments team operates in over 30 countries and includes more than 3,000 professionals, with over 300 based in Australia. Our local and global teams collaborate closely to monitor the markets and build portfolios aimed at driving performance while implementing robust due diligence and active risk management.

Important principles we follow:

Diversification

Investing in a diverse range of assets, geographies and sectors seeking to reduce the overall impact of high volatility in other assets. Much like the saying 'don’t put all your eggs in one basket.'

Investment Strategy

We take a thoughtful and adaptable approach to investing. This means assets are chosen based on careful planning, and we’re ready to adjust our strategy as market conditions change.

Modelling

Implementing robust risk management practices that consider a variety of possible market outcomes, and how best to prepare for them and to respond should they occur.

Read next:

Market volatility and your super

As a superannuation member, your super balance is typically invested in various asset classes and financial markets - and volatility is unavoidable. So don't be alarmed when your balance dips from time to time.

Investment risk and your super

Risk is something many of us naturally avoid, especially when it comes to our personal well-being or our finances. Reward on the other hand, is a word that draws us in. When it comes to investing, risk and rewards are intrinsically linked.

Diversification and your super

We all know the phrase "don't put all your eggs in one basket". If you drop your only basket, you break all your eggs. But if you have many baskets and you drop one, you have eggs to spare. That's diversification in a nutshell.

**Past performance is not a reliable indicator of future performance. The value of an investment in Mercer Super may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

1. Based on Mercer Super Corporate Super Division membership data as at 31 March 2025 and for members invested for the entire corresponding time period. Mercer Super Trust’s analysis of Mercer SmartPath, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2025. Mercer Super Trust’s analysis of Mercer Super’s Ready-made diversified investment options in the Corporate Super Division, compared to its respective growth asset ratio fund survey’s median as reported in SuperRatings Fund Crediting Rate Survey as at 31 March 2025.

2. Based on Mercer SmartPath Corporate Super Division membership data as at 31 March 2025 and for members invested for the entire corresponding time period. Mercer Super Trust’s analysis of Mercer SmartPath, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 March 2025.

3. Based on all Mercer SmartPath Corporate Super Division cohorts with members aged under 60 (with the exception of cohorts Born 2004-2008, Born 2009-2013 and Born 2014-2018 which have insufficient performance history to complete an assessment over all time periods) for members invested for the entire corresponding time period. Mercer Super Trust analysis of Mercer SmartPath performance (after investment fees and taxes) for the 1,3,5,7, and 10-years to 31 March 2025.

4. Mercer Super Trust’s analysis of Mercer Super’s Ready-made diversified investment options in the Corporate Super Division, compared to its respective growth asset ratio fund survey’s median as reported in SuperRatings Fund Crediting Rate Survey as at 31 March 2025. The Mercer Select Growth investment option has not yet reached 10 years since inception.

5. Mercer Super Trust’s analysis of financial market asset class returns and economic insights.

Disclaimer

Issued by Mercer Superannuation (Australia) Limited (MSAL) ABN 79 004 717 533, Australian Financial Services Licence 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’).

Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice we recommend you obtain your own financial advice and consider the Product Disclosure Statement available at mercersuper.com.au. The product’s Target Market Determination setting out the class of people for whom the product may be suitable can be found at mercersuper.com.au/tmd.

This information is based on information received in good faith from sources we believe to be reliable and accurate. Any reference to legislation reflects our understanding of the legislation and is not a substitute for legal advice. Before making any decision concerning the impact and application of laws to your circumstances, we recommend you obtain your own legal or other appropriate professional advice. No warranty as to the accuracy or completeness of this information is given and no responsibility is accepted by Mercer or any of its related entities for any loss or damage arising from any reliance on the information.

Ratings are likely to change and are only one factor to be taken into account when deciding to invest in a product.

‘MERCER’ and ‘Mercer SmartPath®’ are Australian registered trademarks of Mercer (Australia) Pty Ltd ABN 32 005 315 917. ©2025 Mercer. All rights reserved.