Quarterly performance update

October to December 2023

Financial markets finished 2023 on a high note, resulting in strong quarterly and calendar year returns for most Mercer Super members.1

Driven largely by the anticipated end to interest rate hikes – and the possibility of rate cuts in 2024 – December 2023 quarter returns were positive across all major asset classes.

To read more, including detailed performance information download the full report below.

Super performance

Mercer SmartPath®

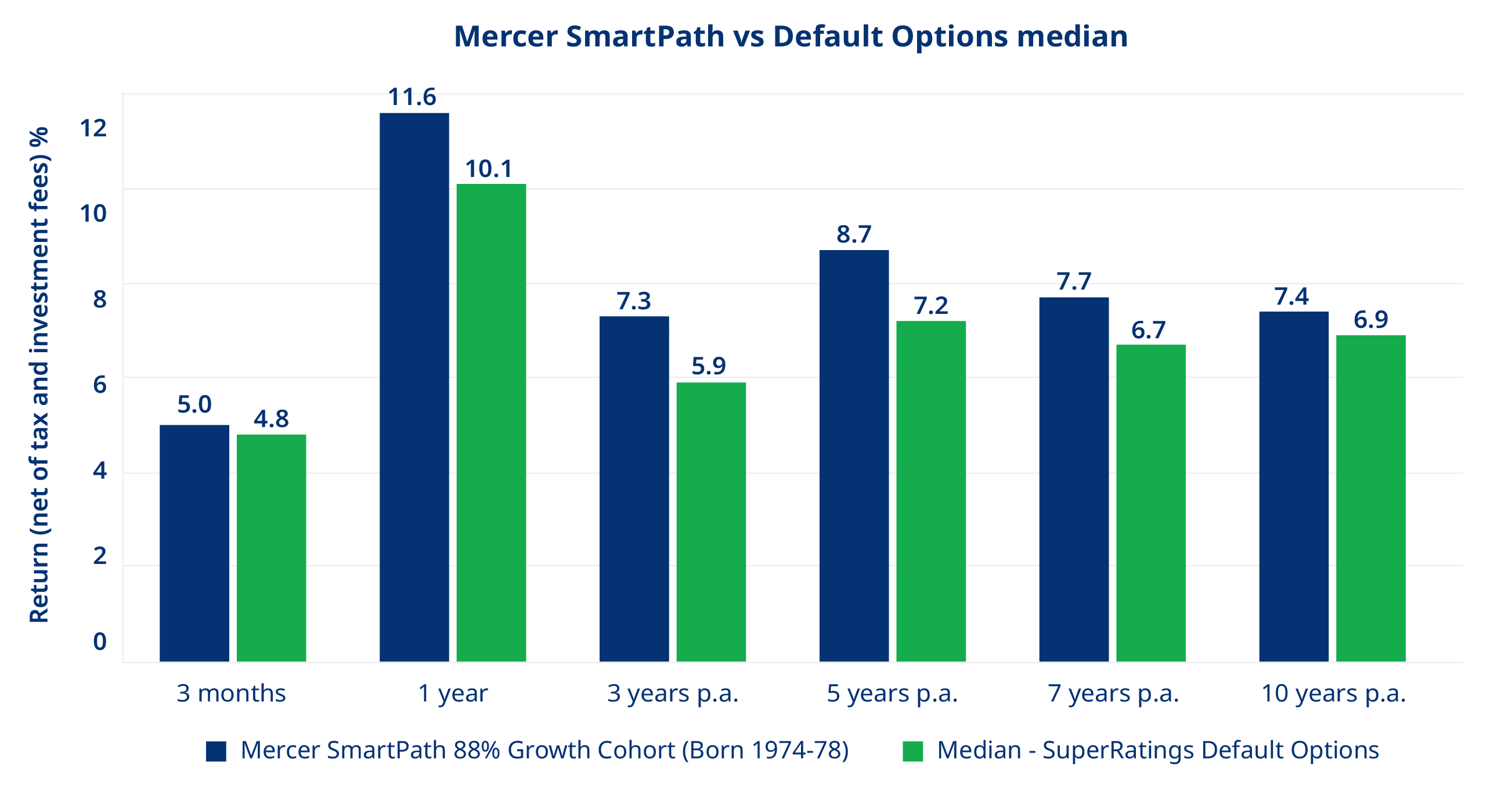

Our default investment option, Mercer SmartPath® recorded solid returns for the December 2023 quarter, ranging from 3.7% to 5.3%.2 Over the 2023 calendar year, most SmartPath members benefitted from double-digit returns, ranging from 10.7% to 11.7%.3

Over the longer term – where super is best measured – Mercer SmartPath continues to deliver returns above the industry median across all time periods, including 10-year returns of 7.4%.4

Mercer SmartPath vs Default Option median

(after tax and investment fees) 31 December 2023

Mercer Super Trust’s analysis of Mercer SmartPath (born 1974-1978), compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 December 2023.

Past performance should not be relied upon as an indicator of future performance.

Ready-made diversified investment options

It was also a positive quarter for our Ready-made diversified options, with returns ranging from 3.3% to 4.5%. The best performing options were those with higher allocations to growth assets, particularly shares and listed property.

Over the longer term, our Ready-made diversified options continue to perform, generally in line with their industry benchmark over 3, 5, 7 and 10 years.5

Investment market update

Markets performed well above expectations in 2023, with a December 2023 quarter rally driven by positive economic growth figures, falling inflation and strong indications that interest rate cuts are on the cards for 2024.

While Australian and international shares and listed property were standout performers, all asset classes finished 2023 on a high.6

- International shares delivered an outstanding 23% return over the calendar year (5.3% for the quarter), led by strong growth in US technology shares.

- Australian shares delivered a healthy 12.1% over the year with a strong final quarter return of 8.4%.

- Listed property (REITs) rallied following a slump in 2022, with Australian listed property up 17.6% over the 2023 calendar year and Global listed property gaining 7.9% over the same period. Most of these gains were earned in November and December as rate cut expectations materialised.

- Cash, which benefited from the higher interest rate environment over much of the year, returned 3.9% for 2023 (1.1% for the quarter).

Related:

Annual Members’ Meeting

Missed the Annual Members’ Meeting? The meeting recording and minutes will be available by the end of April.

Read next:

Diversification and your super

We all know the phrase “don’t put all your eggs in one basket”. If you drop your only basket, you break all your eggs. But if you have many baskets and you drop one, you have eggs to spare. That’s diversification in a nutshell: more baskets = less chance of losing all your eggs in a single stroke.

Investment risk and your super

Risk is something many of us naturally avoid, especially when it comes to our personal well-being or our finances. Reward on the other hand, is a word that draws us in. When it comes to investing, risk and reward are intrinsically linked.

Keep on top of your super performance

Stay informed with Mercer Super.

Access your investment performance reports, daily unit prices and comparisons.

1. Based on Mercer Super membership data as at 31 March 2023 and for members invested for the entire corresponding time period.

2. Mercer Super Trust’s analysis of the Mercer SmartPath investment performance (after investment fees and taxes) for the December 2023 quarter.

3. All Mercer SmartPath cohorts with members aged under 60 years returned at least 10.7% (after investment fees and taxes) for the 2023 calendar year (when invested for the full 2023 calendar year).

4. Mercer Super Trust’s analysis of Mercer SmartPath Born 1974-1978 investment performance, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 31 December 2023.

5. Mercer Super Trust’s analysis of Mercer Super’s Ready-made investment options, compared to their respective growth asset ratio fund survey median as reported in SuperRatings Fund Crediting Rate Survey as at 31 December 2023.

6. Mercer Super Trust analysis of financial market asset class returns - Quarterly report to 31 December 2023.

The material contained in this document is based on information received in good faith from sources within the market and on our understanding of legislation and government press releases at the date of publication which we believe to be reliable and accurate. Neither Mercer nor any of its related parties accepts any responsibility for any inaccuracy. All performance figures stated above are for investment options available in the Corporate Super Division of the Mercer Super Trust. Past performance is not a reliable indicator of future performance. Any advice contained in this document is of a general nature only, and does not take into account the objectives, financial situation or personal needs of any particular individual. Prior to acting on any information contained in this document, you need to consider the appropriateness of the advice taking into account your own objectives, financial situation and needs, consider the Product Disclosure Statement for any product you are considering, and seek professional advice from a licensed, or appropriately authorised financial adviser if you are unsure of what action to take. The product Target Market Determination can be found at mercersuper.com.au/tmd. Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’). 'MERCER’ is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.