Lower administration fees,†† means more money in your super

So, how do our admin fees stack up?

Because paying lower admin fees†† means more money in your super.

With this in mind our MySuper SmartPath® standard admin fees are between 16% and 36% below the MySuper market average, depending on your account balance.††

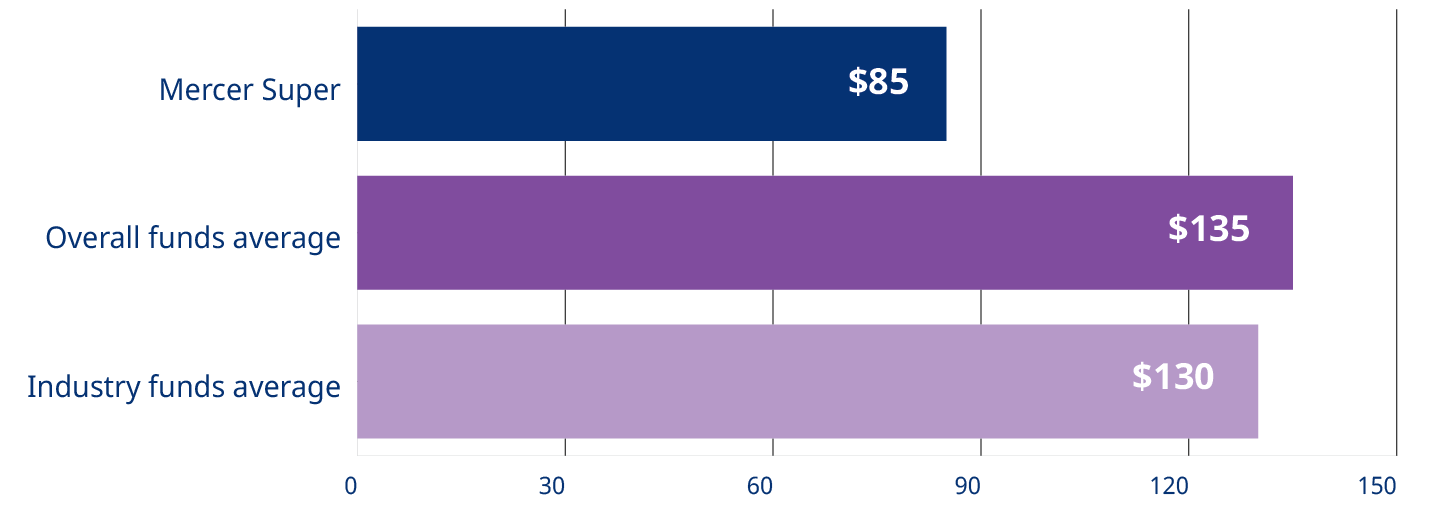

Annual administration fee on $50,000 account balance

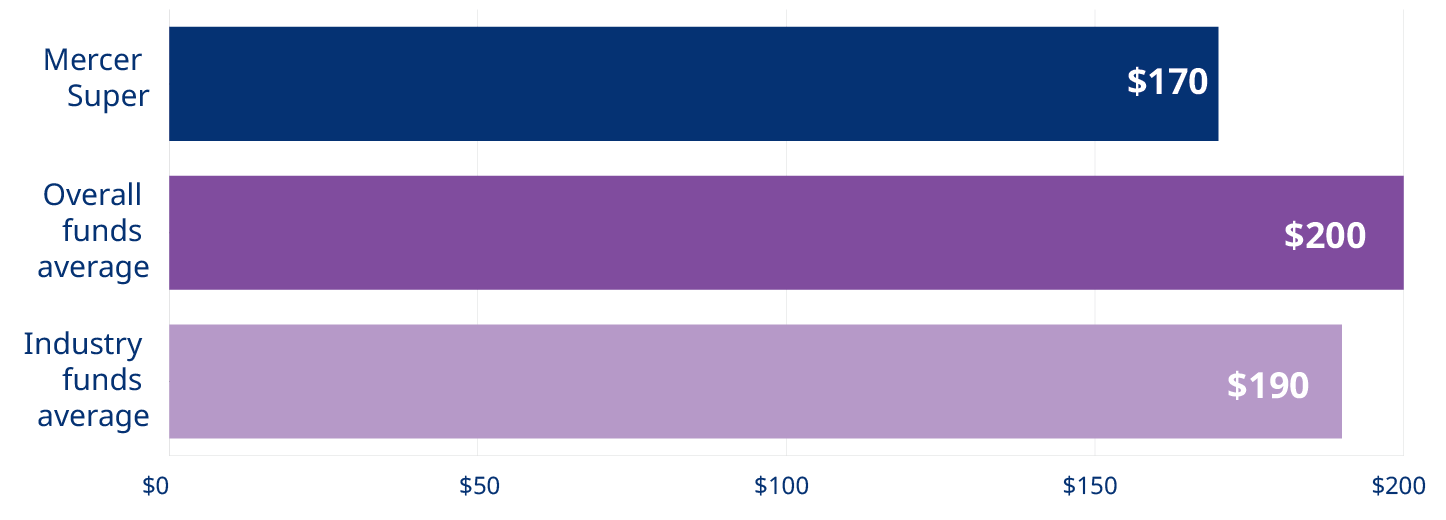

Annual administration fee on $100,000 account balance

†† ChantWest MySuper Default Fee Tables March 2025 – for $50,000 and $100,000 account balances. Fees are for Mercer SmartSuper - SmartPath® (our MySuper product) as at 31 March 2025 for total administration fees and costs. Chant West uses our 1964-1968 investment option for purposes of comparison with other MySuper funds. You may pay less than this if you are in an employer plan with discounted fees. For more details on fees for each of our SmartPath options, or if you’ve chosen your own investment option/s, go to the ‘How Your Super Works' guide online. Fees and costs can vary from year to year. Past fees and costs are not a reliable indicator of future fees and costs. Fees and comparisons may differ for other investment options and account balances.

What fees do members pay?

All super funds charge fees to cover various costs related to your super account. These can include admin fees and costs, investment fees and costs, transaction costs to manage and invest your money, and insurance fees to cover premiums. At Mercer Super we’re committed to helping our members keep more of their money where it belongs – in their super account. By offering low admin fees†† we’re able to help members do exactly that.

Administration fees and costs

Unlike some other super funds, Mercer Super members do not pay a dollar-based administration fee.

The asset-based administration fee for Mercer SmartPath® members with a balance up to $500,000 is 0.10%.

For members in Mercer SmartPath with a balance in excess of $500,000, there is no asset-based administration fee for the amount of the balance over $500,000.1

Members also pay an estimated expense allowance range of between 0.00% to 0.05% per annum of their super account balance, and estimated 0.02% p.a. of Mercer Super assets paid from the member reserve.

Administration fees

| % per annum of your super account balance | ||

|---|---|---|

| Investment option | First $500,000 |

Balance over $500,000 |

| Mercer SmartPath® | 0.10% | 0.00% |

| All other investment options | 0.15% | 0.00% |

Investment fees and costs

Members pay investment fees depending on their investment selection. For Mercer SmartPath® , members born prior to 1959 pay 0.34% while members born in 1959 or later will pay 0.40% per annum of their super account balance.

Members also pay other investment costs. For Mercer SmartPath: Estimated investment costs of between 0.15% to 0.31% per annum of your super account balance, depending on which path you are in.

For all other investment options (except Mercer Direct): Estimated investment costs of between 0.02% to 0.45% per annum of your super account balance depending on which investment option you choose.2

Investment fees

| Path | % per annum of your super account balance |

| Born prior to 1959 |

0.34% |

| Born 1959 or later |

0.40% |

How do I find out more about Mercer Super fees and costs?

You can see all of our standard fees and costs for all Mercer SmartSuper investment options in the How Your Super Works guide which you can find online. The guide includes a table with a summary of the standard costs per year for each of our investment options for a $50,000 balance, which you can use to compare your Mercer Super with other super funds and investment options. You can also check your annual statement which will show the total dollar value charged in fees for the statement period.

If you’re a member of an employer sponsored plan – your fees may be the same as, or less than, our standard fees.

Join Mercer Super today

Become a member and join more than 1 million other Australians already enjoying the benefits Mercer Super offers

†† ChantWest MySuper Default Fee Tables March 2025 – for $50,000 and $100,000 account balances. Fees are for Mercer SmartSuper - SmartPath® (our MySuper product) as at 31 March 2025 for total administration fees and costs. Chant West uses our 1964-1968 investment option for purposes of comparison with other MySuper funds. You may pay less than this if you are in an employer plan with discounted fees. For more details on fees for each of our SmartPath options, or if you’ve chosen your own investment option/s, go to the ‘How Your Super Works' guide online. Fees and costs can vary from year to year. Past fees and costs are not a reliable indicator of future fees and costs. Fees and comparisons may differ for other investment options and account balances.

1 Excluding investments in Mercer Direct where the asset-based administration fee remains unchanged – and is applied to the total of your account balance invested in Mercer Direct.

2 The investment costs and transaction costs are as at 20 June 2025 and are based on the actual information available and/or reasonable estimates for the financial year ending 30 June 2024. Where applicable, performance fees are based on an average for the five-year period ending 30 June 2024 (or a shorter period if the option has an inception period less than five years) and are included in investment fees and costs. If the actuals are not available for the most recent financial year, we may use a reasonable estimate for that year. For some investment managers, the expenses and performance based fees are based upon the twelve months to 30 June 2024, and for others, earlier dates. Where earlier dates have been used, they represent the latest information provided by investment managers, and we expect them to be similar for the 30 June 2024 financial year. Investment and transaction costs may vary from year to year. For more details see ‘Investment fees and costs’ and ‘Transaction costs’ in the ‘Additional explanation of fees and costs’ section of the How Your Super Works Guide online.

* Mercer Super has been recognised with several SuperRatings awards, including SuperRatings' highest platinum rating for both our Allocated Pension Division (now known as Mercer SmartRetirement Income) and Corporate Superannuation Division products. Mercer SmartRetirement Income and the Corporate Superannuation Division products also received SuperRatings Platinum Performance awards, based on investment returns, fees, insurance, member servicing, administration and governance for 10 and 15 years respectively. Ratings issued by SuperRatings Pty Ltd a Corporate Authorised Representative (CAR No.1309956) of Lonsec Research Pty Ltd AFSL No. 421445 are general advice only. Rating is not a recommendation to purchase, sell or hold any product and subject to change without notice. SuperRatings may receive a fee for the use of its ratings and awards. Visit SuperRatings.com.au for ratings information.

Mercer Super has been recognised with several Chant West Apple Ratings for 2025, including 5 Apples - Highest Quality Fund rating for Mercer Super's super products Mercer SmartSuper Plan - Employer, Mercer SmartSuper Plan - Individual, Mercer SmartSuper and Mercer Business Super, as well as Mercer Super's pension product Mercer SmartRetirement Income. The Zenith CW Pty Ltd ABN 20 639 121 403 AFSL 226872/AFS Rep No. 1280401 Chant West rating (assigned February 2025) is limited to General Advice only and has been prepared without considering your objectives or financial situation, including target markets where applicable. The rating is not a recommendation to purchase, sell or hold any product and is subject to change at any time without notice. You should seek independent advice and consider the PDS or offer document before making any investment decisions. Ratings have been assigned based on third party data. Liability is not accepted, whether direct or indirect, from use of the rating. Refer to chantwest.com.au for full ratings information and their FSG.

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice, please consider the Product Disclosure Statement available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd.

Past performance is not a reliable indicator of future performance.

Ratings are likely to change and are only one factor to be taken into account when deciding to invest in a product.

The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed.

'MERCER’ is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917. Copyright ©2024 Mercer. All rights reserved.