A Transition to Retirement (TTR) strategy can be a useful way to ease into retirement while you’re still working, but it’s not for everyone

Once you’ve reached age 60, a TTR strategy allows you to access up to 10% of your super each financial year while you continue working.

Setting up a TTR account

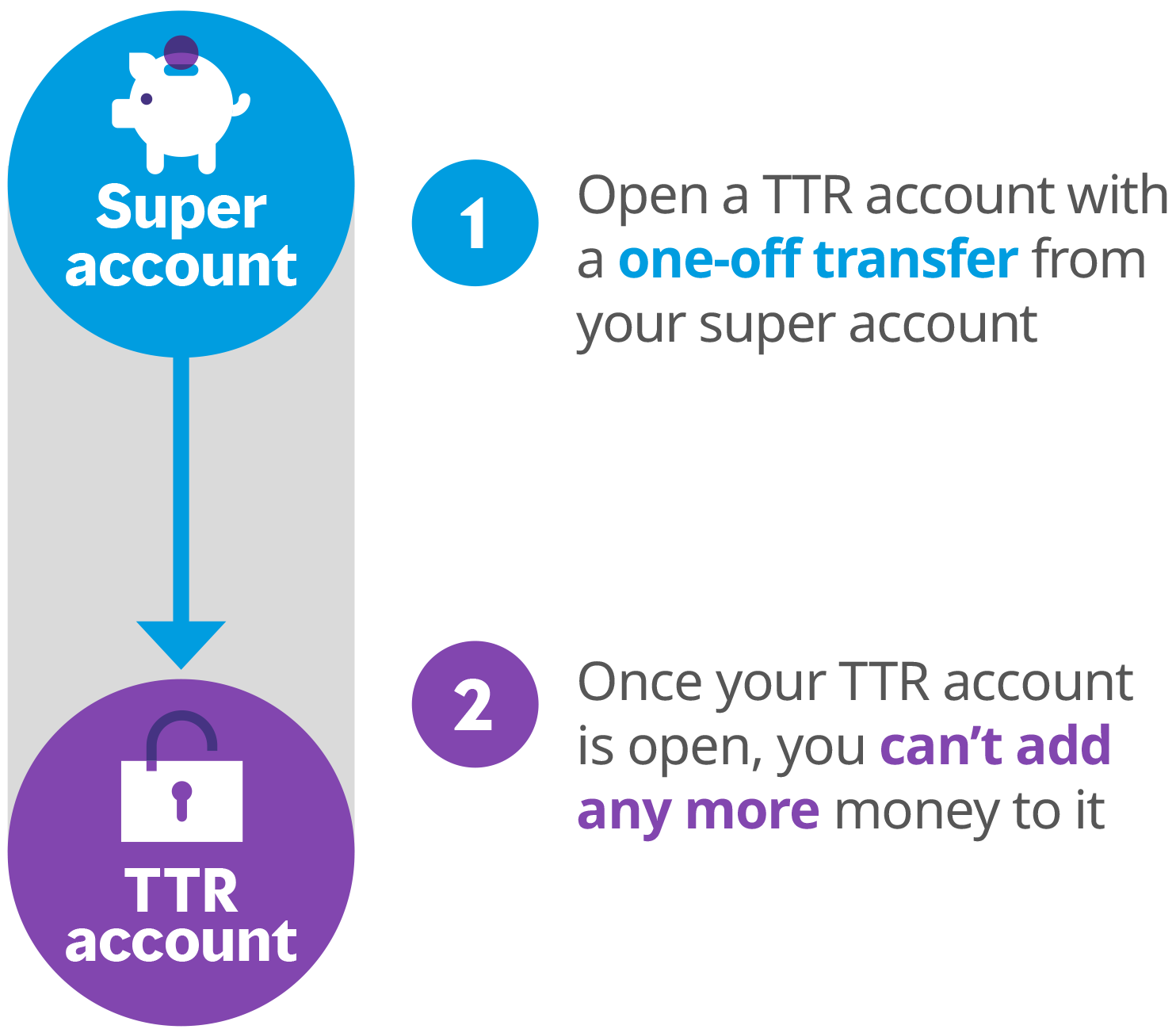

To start a TTR strategy you'll need two accounts: a super account and a TTR pension account.

Next, transfer a portion of your super balance from your existing super account into a your newly opened TTR pension account. A minimum account balance may be required to start a TTR pension account.

You can’t add money to a pension account once it’s set up. But because you’re still working, you will continue to receive employer (SG) contributions.

That’s why you need a super account, to receive SG as well as any additional contributions you might want to make.

Both your super and TTR account balances remain invested. Your investment earnings are taxed at 15%.

Keeping your super account open is also useful if you have insurance attached to your super and you want to keep it. You’ll just need to maintain a super account balance of at least $6,000.

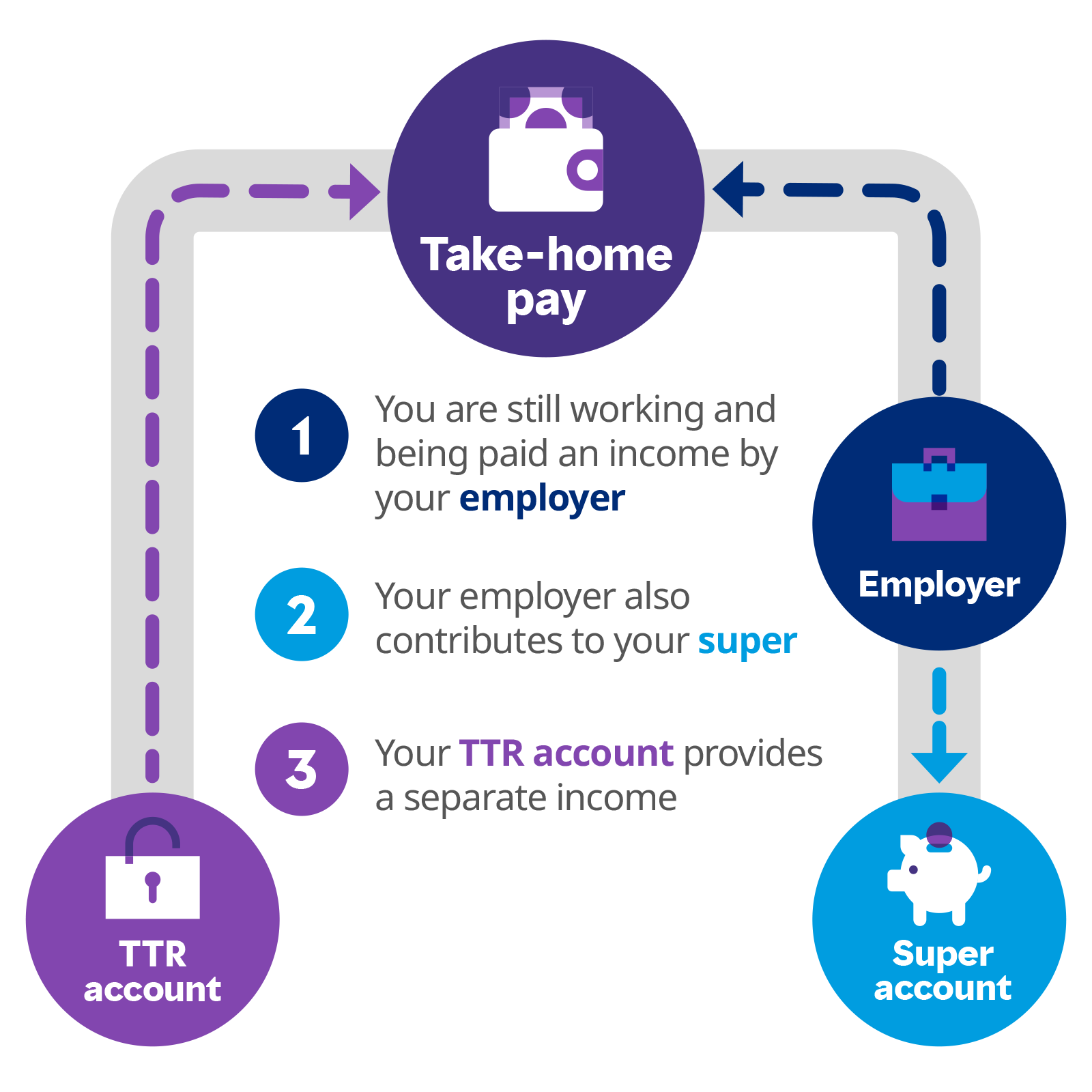

How a TTR strategy works

- A TTR strategy is used while you're still working and receiving an income from your employer.

- You will receive employer contributions to your super, usually taxed at 15%.

- Meanwhile, your TTR account provides a regular tax-free payment to top up your take-home pay.

You can choose to receive TTR pension payments annually, half-yearly, quarterly, monthly or twice monthly. You can draw a tax-free income of between 4% and 10% of your TTR account balance each financial year.

How can a TTR strategy help me transition to retirement

Depending on your personal circumstances and financial goals, there are three ways you can use a TTR strategy between age 60 and 65. Let’s explore these options through the perspective of Naveen, who has just turned 60 and wants to start a TTR strategy.

- Naveen

- Age: 60

- Monthly pre-tax income: salary of $8,137 (not including Superannuation Guarantee).

- Monthly take-home pay: $6,332.

- Mercer Super account balance: $300,000. Naveen transfers $270,000 to his newly opened TTR account.

- Mercer SmartRetirement Income TTR account balance: $270,000.

The following examples are intended as general information only and should not be considered personal advice. Calculations and figures are approximate only and are based on 2024-25 income tax rates. We recommend you seek financial advice tailored to your personal circumstances.

Option #1

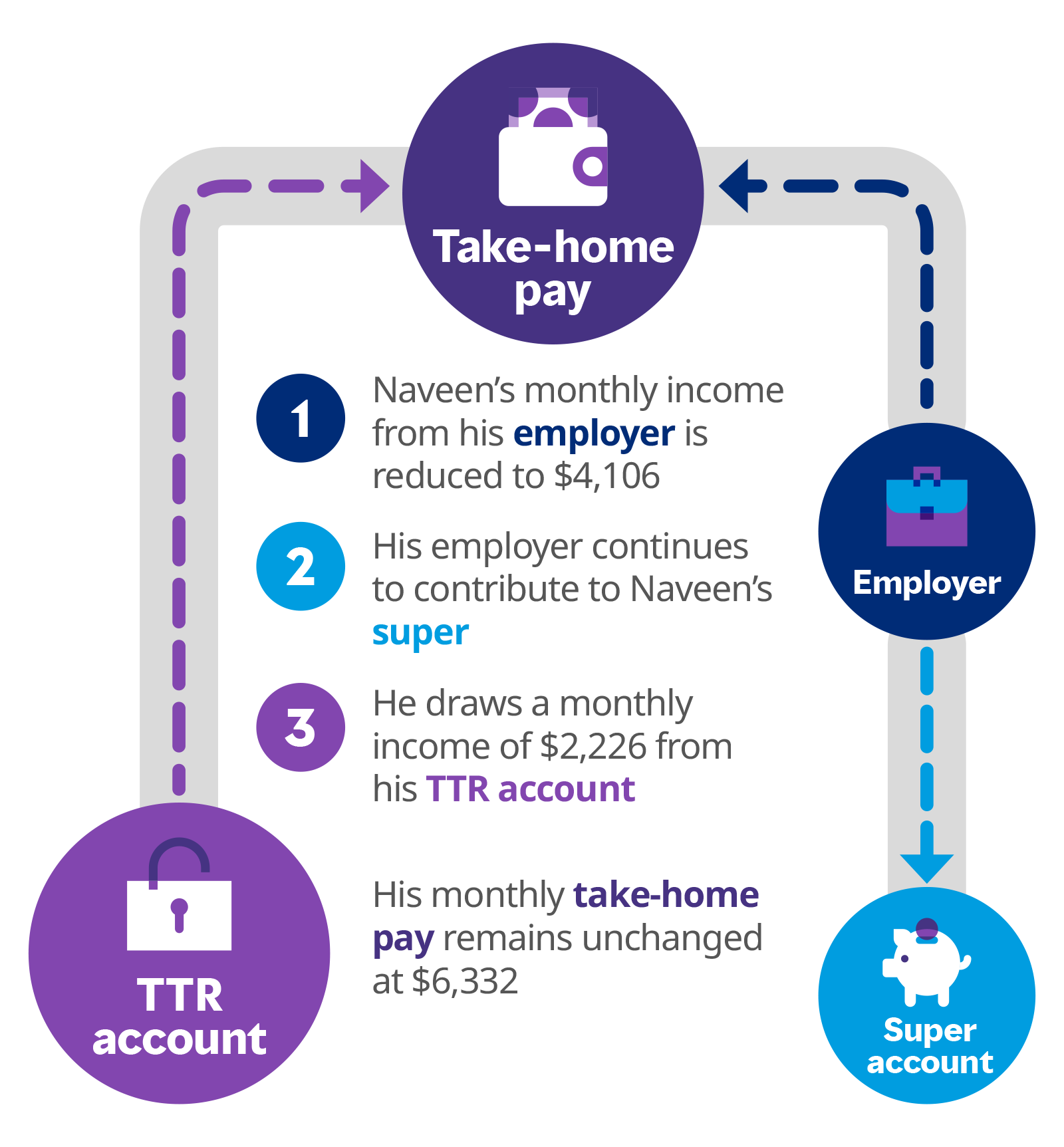

Semi-retire without losing income

This strategy would help Naveen cut back his work hours and top up his take-home pay with tax-free income from his TTR account.

Naveen reduces his work hours from five to three days a week, so his pre-tax salary is reduced by 40%.

- Naveen’s monthly take-home pay is cut to $4,106.

- His employer continues to contribute to Naveen’s super.

- Naveen makes up the difference in take-home pay by drawing a monthly income of $2,226 from his TTR account.

His total take-home pay remains unchanged at $6,332.

Option #2

Boost your super savings without losing income

This strategy allows Naveen to boost his super with salary sacrifice contributions without reducing his take-home pay. Naveen continues to work 5 days per week (full-time).

- In addition to his employer contributions, Naveen makes a salary sacrifice contribution of $1,323 each month to his super.

- His before-tax salary is reduced to $6,864 and his monthly pay is cut to $5,430.

- He makes up the difference by drawing a monthly income of $902 from his TTR account.

His total take-home pay remains unchanged at $6,332.

Tax savings: By salary sacrificing to super, Naveen may be able to save over $5,000 income tax over the financial year, money that would otherwise have gone to the Australian Tax Office.*

Option #3

Access some of your super to pay for large expenses

This strategy allows Naveen to access up to 10% of his TTR account balance each financial year to pay for big ticket items like paying off his mortgage, renovating his home, or helping his family financially.

- Naveen continues to work full time and his regular monthly income remains unchanged at $6,332.

- His employer continues to contribute to Naveen’s super.

- To pay for home renovations, Naveen withdraws $27,000 from TTR account in a single, annual payment

These strategies won’t suit everyone. A TTR strategy can be a useful and convenient way to ease into retirement, but it can also be complex, particularly in its implications for contributions caps and tax laws. We recommend you seek financial advice tailored to your personal circumstances.

The right advice can help you make the right choice

No matter where you’re at in life, the right advice at the right time can help you take charge of your super and retire with confidence. With Mercer Super, accessible advice is always within easy reach.

Explore more: it’s your time to prepare

Disclaimer: This content has been prepared on behalf of Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust (‘Mercer Super’) ABN 19 905 422 981. Any advice is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice, please consider the Product Disclosure Statement (including incorporated documents) and Financial Services Guide available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd. The material contained in this document is based on information received in good faith from sources within the market and on our understanding of legislation which we believe to be accurate.

Care & Living with Mercer is a service provided by Mercer Consulting (Australia) Pty Ltd ABN 55 153 168 140. Please read Care & Living with Mercer website Terms of Use when accessing the service.

* Any information in this material regarding legal, accounting or tax outcomes does not constitute legal advice or an accounting or tax opinion and prior to relying and acting on this information it is important that you seek independent advice from a qualified lawyer or accountant regarding this information. Past performance is not a reliable indicator of future performance. 'MERCER' is a registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.

Past performance is not a reliable indicator of future performance. 'MERCER' is a registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.