Investments update

July to September 2023

Financial markets went backwards in the last quarter (1 July to 30 September), but it’s important to remember that super is a long-term investment.

Despite an environment of higher inflation, higher interest rates and geopolitical uncertainty, our long-term investment strategy continues to deliver healthy and positive returns for our members, over the long term.

To read more, including detailed performance information download the full report below.

Super performance

For the first time this year many Australian superannuation members experienced negative returns over the third quarter of 2023, as investment markets adjusted to the expectation of further interest rate rises.

Higher interest rates and slowing economic growth combined to weaken investor confidence, leading to negative returns across share markets and declines in other asset classes, including fixed interest, property, and infrastructure.

Due largely to the benefits of diversification within Mercer Super, for most members1 these losses were less than the broader market and industry median.2

Mercer SmartPath

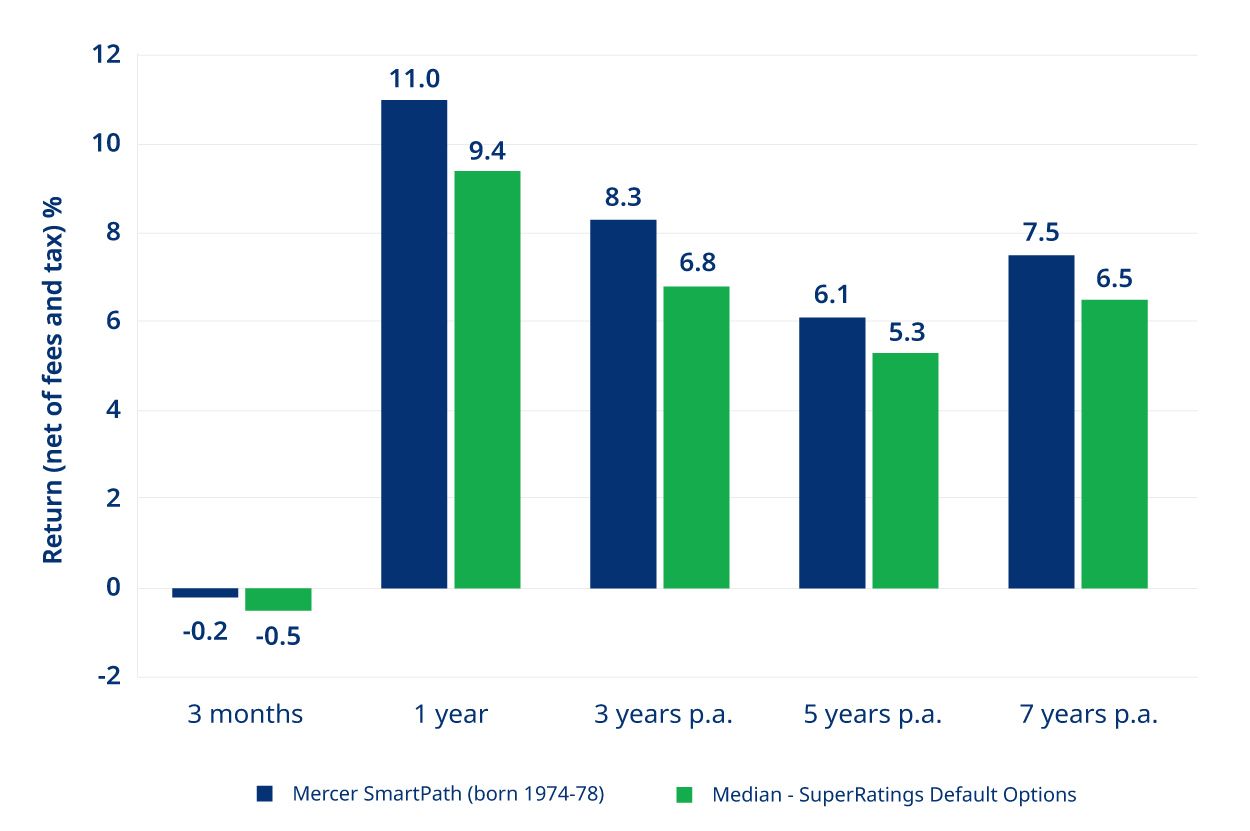

Our default investment option, Mercer SmartPath® experienced a mild negative return over the three months to 30 September, with returns in a tight range of -0.2 to -0.3%. Despite the negative result, Mercer SmartPath performed better than the Default Options median which saw a loss of -0.5%.3

For the 12 months to 30 September, Mercer SmartPath has achieved a positive return of 11.0%.

Over the longer term – where super is best measured – the overwhelming majority4 of Mercer SmartPath members continue to enjoy above median returns across all time periods, with mostly top quartile performance.3

Mercer SmartPath vs Default Option peers

(after tax and investment fees) 30 September 2023

Ready-made investment options

It was a negative quarter for most of our other Ready-made choice options , with returns ranging from 0.1% to -0.4% (Conservative Growth to High Growth). These results are comparable or better than all peer group medians across the industry.5

The Mercer Diversified Shares option suffered a loss of -0.8% (which is to be expected considering the option’s exposure to shares only) but the Mercer Select Growth option managed a small gain of 0.1%.

Over the longer term, these options are performing well against their respective peer group medians over 3, 5 and 7 years.5

Investment market update

Oil prices rose sharply over the September quarter – up 28% to more than US$95 a barrel – raising inflation concerns and putting renewed pressure on central banks to push interest rates higher.

Government bond yields continued their upward path globally, due to higher interest rate expectations, leading to negative returns in fixed income asset classes.

“Higher-for-longer” interest rate expectations led to a sell-off in bond markets over the quarter, which in turn contributed to declines in Australian and overseas share markets. Australian shares dropped -0.8% over the quarter while overseas shares fell -2.7% (unhedged -0.4%).

Cash was the only positive asset class, generating a return of 1.1%.

Don’t panic

Markets are likely to experience more ups and downs as inflation, interest rates and geopolitical tensions remain a focus for investment markets in coming months.

It’s important to remember that your super is a long-term investment. While changes in your balance over the short term can be worrying, market volatility and fluctuation in returns are a normal part of investing. History has shown that markets tend to recover from downturns and grow over time.

It may be many years or even decades before you consider withdrawing your super and this provides the opportunity to recover from any negative returns. You will only realise any losses if you switch your investment options or withdraw your super.

Our global investment experts monitor markets, manage risk, and identify opportunities to help minimise the impact of negative returns, and grow your super balance over time.

If you are still considering switching investment options or withdrawing your super, we recommend you seek financial advice before doing so.

Related readings:

Mercer Super performance reports

Access our latest Mercer Super investment performance reports

Find out more

Read next:

How your super is invested

Depending on the investment options you have with us, we’ll invest in a range of asset classes such as Shares, Property, Fixed Interest and Cash.

For every asset class, you can break this further down into underlying assets to see exactly what your super is invested in

Diversification and your super

We all know the phrase “don’t put all your eggs in one basket”. If you drop your only basket, you break all your eggs. But if you have many baskets and you drop one, you have eggs to spare. That’s diversification in a nutshell: more baskets = less chance of losing all your eggs in a single stroke.

Investment risk and your super

Risk is something many of us naturally avoid, especially when it comes to our personal well-being or our finances. Reward on the other hand, is a word that draws us in. When it comes to investing, risk and reward are intrinsically linked.

1. Based on Mercer Super membership data as at 30 June 2023, 57.5% of Mercer Super members and 55% of Mercer Super Trust assets are invested in Mercer SmartPath. All Mercer SmartPath cohorts performed better than the default options median.

2. All ready-made diversified investment options that reported in the SuperRatings Fund Crediting Rate Survey as at 30 September 2023, with the exception of Diversified Shares, achieved above median returns.

3. Mercer Super Trust’s analysis of Mercer SmartPath, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 30 September 2023.

4. Based on Mercer SmartPath membership data as at 30 June 2023 and for members invested for the entire corresponding time period.

5. Mercer Super Trust’s analysis of Mercer Super’s Investment Options, compared to its respective growth asset ratio fund survey’s median as reported in SuperRatings Fund Crediting Rate Survey as at 30 September 2023.

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’). Any advice is of a general nature only, and does not take into account the personal needs and circumstances of any particular individual. Prior to acting on any information, you need to take into account your own financial circumstances. Please consider the Product Disclosure Statement, Product Guide, Insurance Guide, Financial Services Guide and Target Market Determination (TMD) before making a decision about the product, or seek professional advice from a licensed, or appropriately authorised financial adviser if you are unsure of what action to take.

All performance figures stated above are for investment options available in the Corporate Super Division of the Mercer Super Trust. Past performance is not a reliable indicator of future performance. Any advice contained in this document is of a general nature only, and does not take into account the objectives, financial situation or personal needs of any particular individual. Prior to acting on any information contained in this document, you need to consider the appropriateness of the advice taking into account your own objectives, financial situation and needs, consider the Product Disclosure Statement for any product you are considering, and seek professional advice from a licensed, or appropriately authorised financial adviser if you are unsure of what action to take.