Inside your annual statement

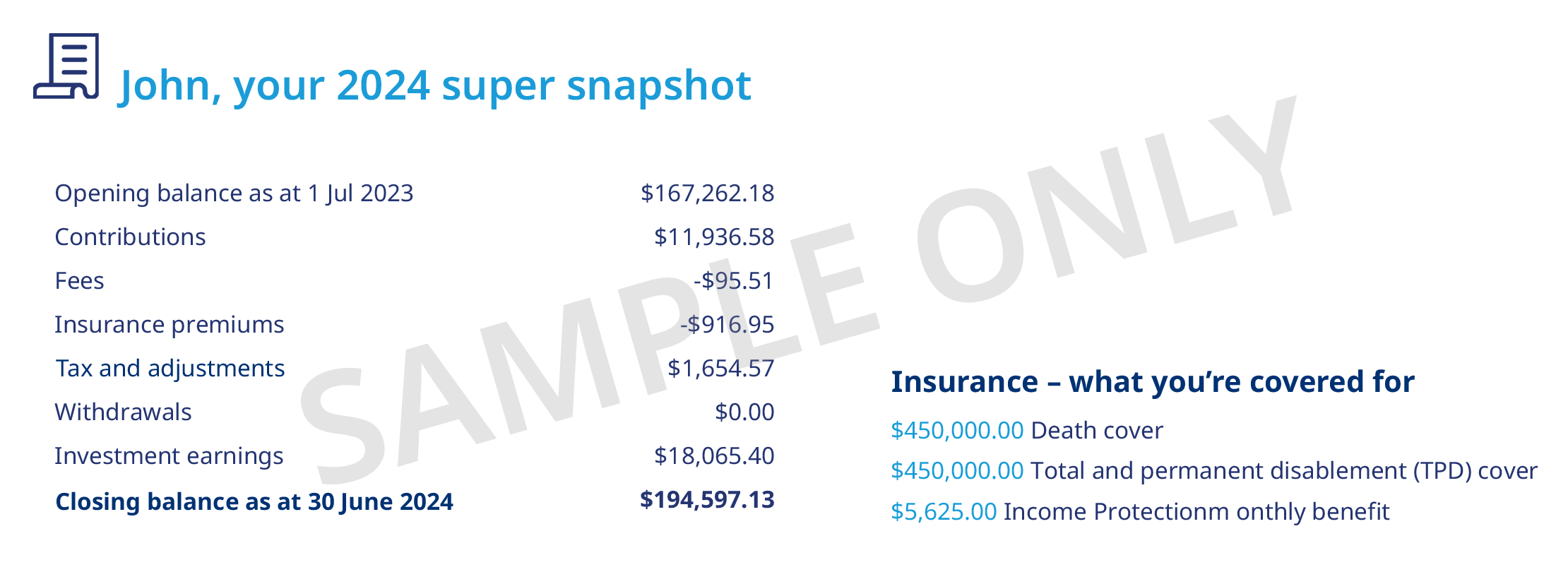

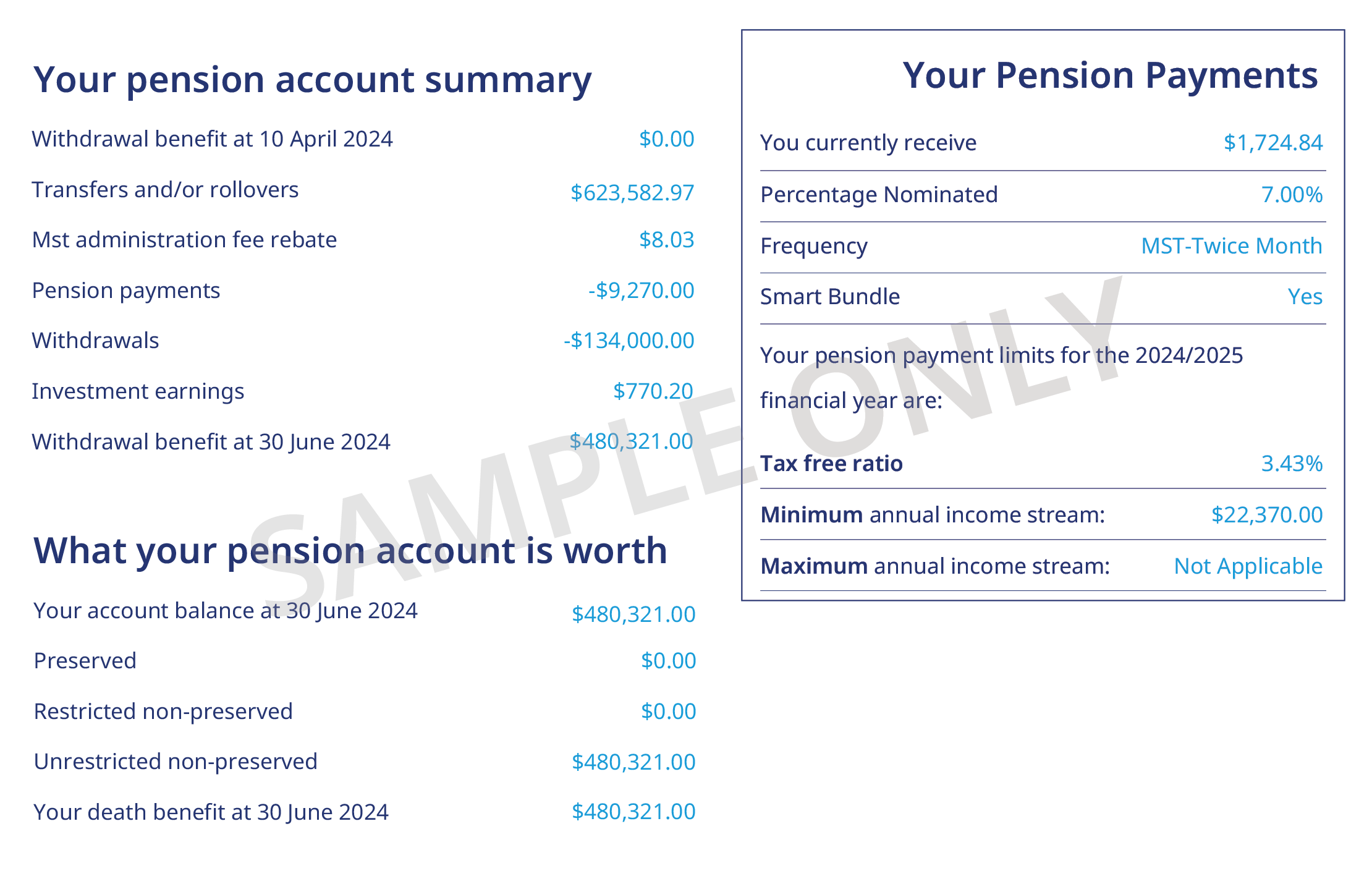

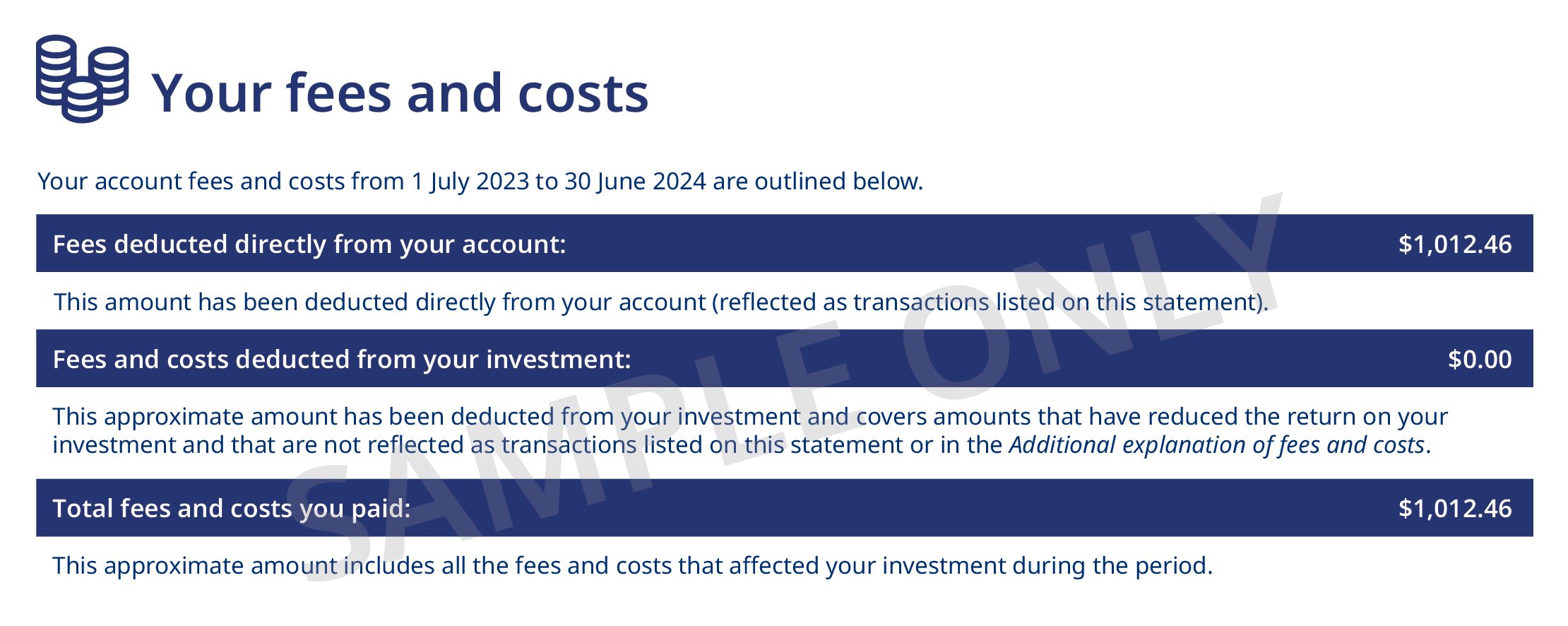

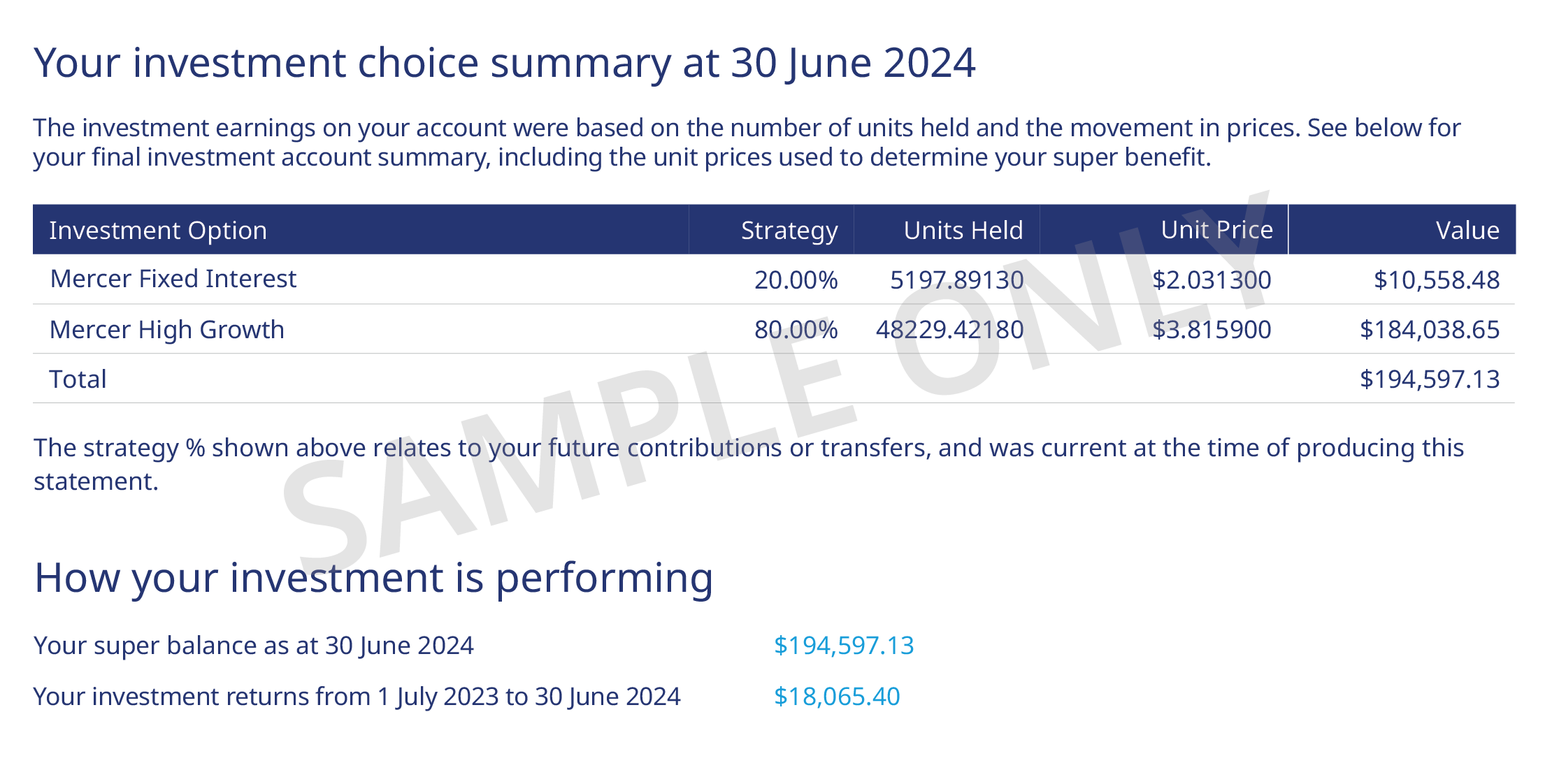

Your annual Mercer Super statement shows you how your super performed over the past financial year, but it’s more than that. Your statement can be a great source of valuable information to help you understand how you’re tracking and the alternatives you might consider to reach your long-term financial goals.

When will you get your annual statement?

Most Mercer Super members will have received their annual statements by mid-October.

- Super statements will start being issued from early August.

- Pension statements will start being issued from mid-August.

Get the most out of your annual statement

To help secure your financial future, you can do a few simple things after receiving your annual statement.

Depending on your account type or when you joined Mercer Super, some of the example images shown below may not match your statement. However, you will still receive the same information.

- Open all

- |

- Close all

Frequently Asked Questions

General

- Open all

- |

- Close all

Fees

- Open all

- |

- Close all

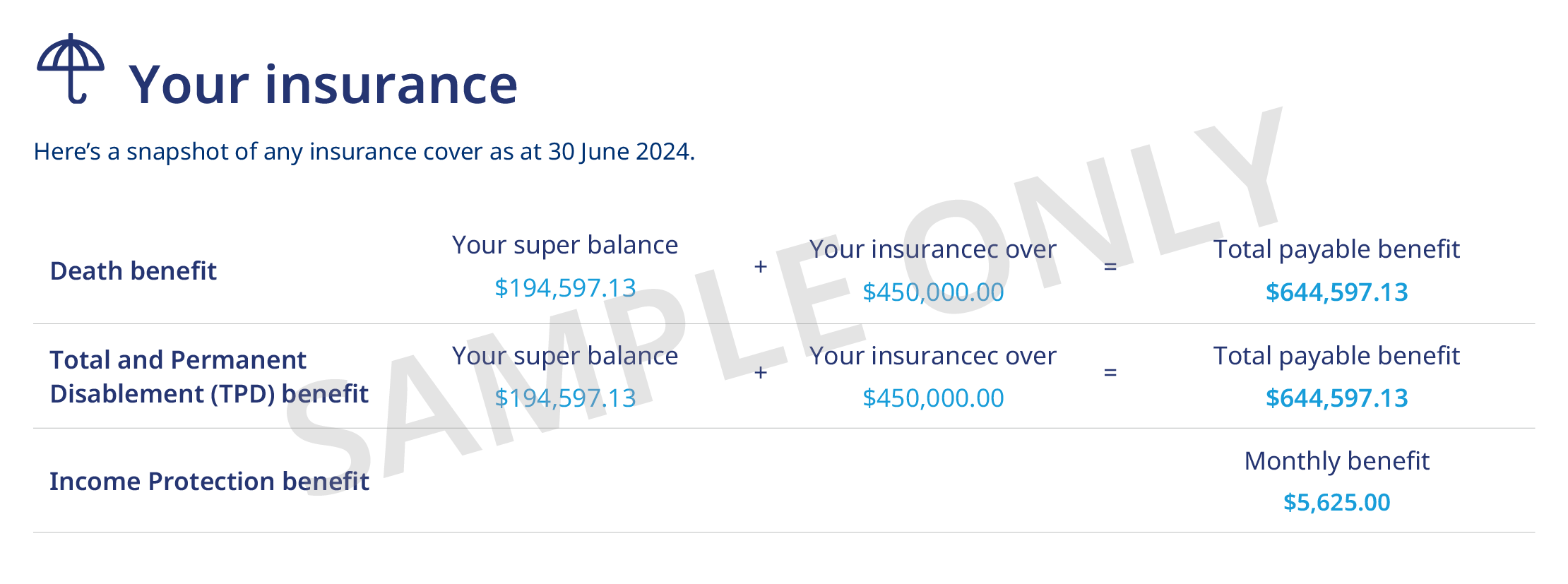

Insurance

- Open all

- |

- Close all

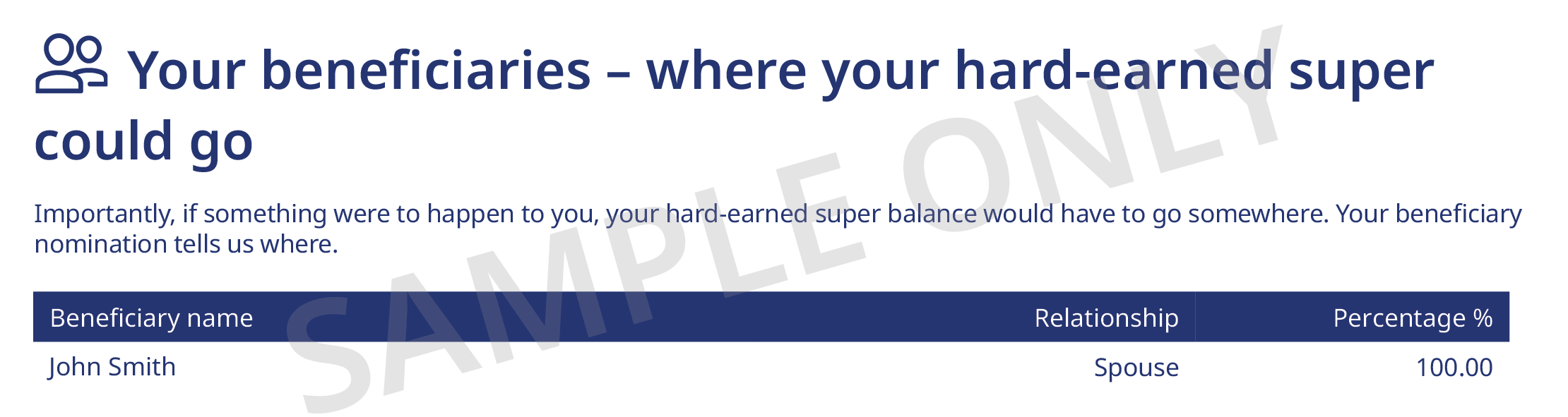

Beneficiaries

Contributions

- Open all

- |

- Close all

Pension payments

Financial advice

Need more help? We’ve got you covered.

Have questions about Mercer Super or need more information about becoming a member? We’d love to hear from you.

Member Online support

Log in to your account for more information or to submit an online enquiry.

Contact our helpline

Visit the member support page or call 1800 682 525, Monday to Friday, 8am-7pm (AEST/ AEDT).

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence # 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice, please consider the Product Disclosure Statement available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd. The material contained in this document is based on information received in good faith from sources within the market and on our understanding of legislation which we believe to be accurate. Neither Mercer nor any of its related parties accepts any responsibility for any inaccuracy. This information is based on the interpretation of current tax laws which may change. You should obtain your own tax advice. Mercer financial advisers are authorised representatives of Mercer Financial Advice (Australia) Pty Ltd ABN 76 153 168 293, Australian Financial Services Licence #411766. The value of an investment in the Mercer Super Trust may rise and fall from time to time. The investment performance, earnings or return of capital invested are not guaranteed. Past performance is not a reliable indicator of future performance.. ‘MERCER’ and ‘Mercer SmartPath®’ are Australian registered trademarks of Mercer (Australia) Pty Ltd ABN 32 005 315 917. Copyright ©2024 Mercer LLC. All rights reserved

Terms of use: Terms & conditions | Privacy | Security