Investments update

April to June 2023

Share markets continued their rally in Q2, closing out FY 2023 with industry-high returns of at least 12% for the majority of Mercer Super members.1

To read more, including detailed performance information download the full report below.

Super performance

Share markets around the world continued to climb throughout Q2 2023.

With many of our investment options, including our default investment option, Mercer SmartPath® having a relatively higher asset allocation to shares, Mercer’s investment experts were able to capitalise on this continued climbing of share markets. This contributed to many of the options delivering robust returns – contributing to Mercer Super’s strong performance and providing our members a significant boost to their super balances.

For FY 2023, overall the superannuation industry delivered solid returns, recovering from the minor losses seen in FY 2022, with both the Default Options median and the Balanced (60-76) median at 9.3%.2 Mercer SmartPath however generated industry-high returns of at least 12% for the majority of our members.1

These strong returns, coupled with some of the most competitive fees in the Australian superannuation market,3 mean our members will have more confidence about their financial future and more savings to rely on when they stop working.

Additionally, Mercer Select Growth delivered a robust 9.6%, placing it as one of the top performing balanced funds for FY 2023.2

Mercer SmartPath

Our default investment option, Mercer SmartPath® delivered positive returns for the second quarter of 2023, with returns for members ranging between 1.1% to 2.7%.

Overall for FY 2023, with returns of at least 12% for the majority of members in Mercer SmartPath®, Mercer Super outperformed many of our largest competitors.1 These results show that despite global economic growth slowing, our investment strategy has stood the test of time and is ultimately making a real difference in our members’ lives.

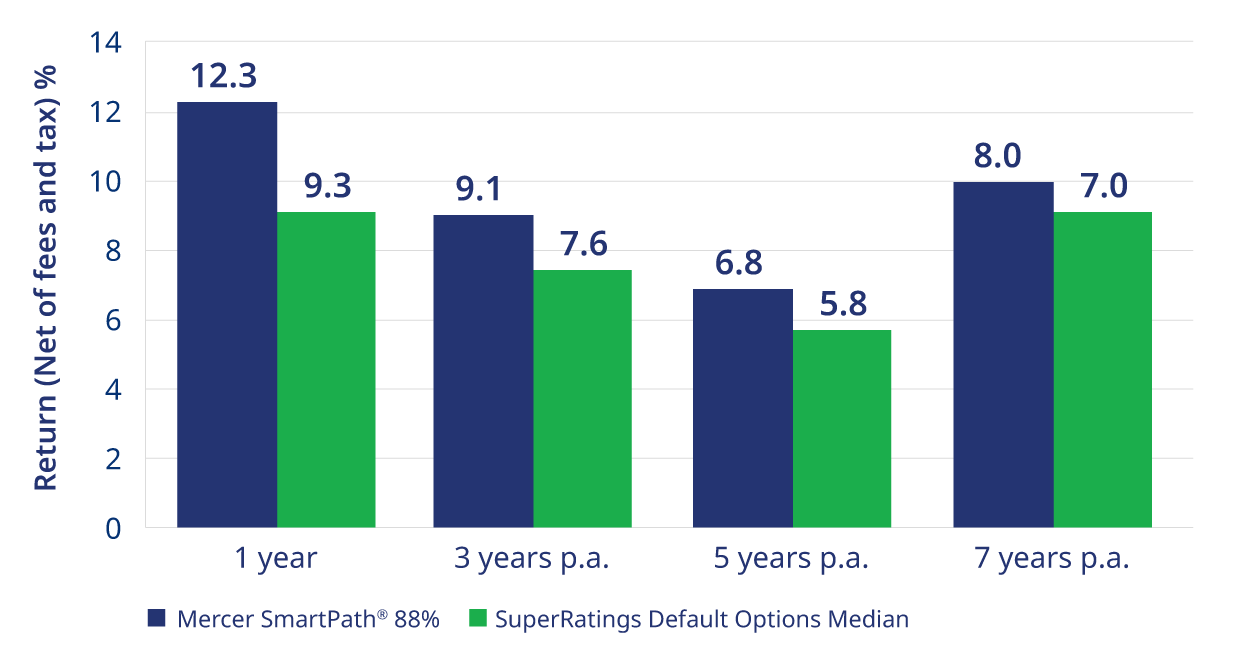

Over the longer term - where super is best measured - we are proud to confirm our investment performance remains strong with the majority of Mercer SmartPath® members aged under 55 continuing to benefit from top quartile investment performance over 1, 3, 5 and 7 years.4

Mercer SmartPath vs Default Option peers

(after tax and investment fees) 30 June 2023

Mercer Super Trust’s analysis of Mercer SmartPath (born 1974-1978), one of the largest cohorts, after investment fees and tax, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 30 June 2023. Note: While Mercer Super did not feature in the official June 2023 survey, Mercer Super is captured in the revised data file.

Ready-made and Sustainable Plus investment options

It was a positive quarter for our diversified ready-made investment options as well, with returns ranging from 0.5% to 3.3%.

For FY 2023, these options had a strong financial year delivering returns comfortably above their respective peer group medians.2

Our Sustainable Plus options also had a positive quarter with returns ranging from 1.1% to 4.2% for Q2. For FY 2023 these options had positive returns ranging between 9.2% to 15.8%. This is with the exception of Mercer Sustainable Plus Conservative Growth which returned a loss of -0.4% for Q2, but an overall positive return of 4.4% for FY 2023.

Investment market update

Global Markets

The second quarter of 2023 was positive for share markets around the world, and generally flat to slightly negative for fixed income.

Despite central banks around the world continuing to fight inflation with even higher interest rates, share markets continued to rise, encouraged by resilience in economic conditions.

Market enthusiasm for the adoption of artificial intelligence by major technology companies has largely driven high returns in International shares, with the NASDAQ 100 Index up over 30% this year alone. Additionally, the S&P 500 is up 20% since October 2022.

Australian Markets

Australian Shares posted a modest return with the S&P/ASX 300 Index gaining 1.0% over Q2. Hedged Developed Market Overseas Shares returned 7.1% (unhedged 7.6%). Additionally, the ASX 200 hit a record high, up 9.7% for FY 2023.

In fixed income, Hedged Overseas Government Bonds returned a loss of -0.7% as bond yields moved higher over the quarter.

Domestically, rising interest rates impacted bond yields, leading to negative returns. Cash was a bright spot, generating a return of 0.9%.

Related readings:

Mercer Super performance reports

Access our latest Mercer Super investment performance reports

Find out more

Read next:

Annual Reports

Each year we publish a Mercer Super Trust Annual Report which contains important information about our fund, any changes that we’ve made, our investment options and performance plus much more.

How your super is invested

Find out what underlying assets your super or allocated pension is invested in.

Care & Living with Mercer

Care & Living with Mercer is here to help Mercer Super members and their loved ones with ageing care needs.

1. After investment fees and tax, Mercer Super Trust’s analysis of Mercer SmartPath, with the exception of Mercer SmartPath – Born 2004-2008, all cohorts with members aged under 55 years returned at least 12% for the 2022/23 financial year (and invested for the full 2022/23 financial year). This compares to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 30 June 2023 of 9.3%. Note: While Mercer Super did not feature in the official June 2023 survey, Mercer Super is captured in the revised data file. Based on Mercer SmartPath membership data as at 31 March 2023 and for members invested for the full 2022/23 financial year.

2. Mercer Super Trust’s analysis of Mercer Super’s Investment Options, compared to its respective growth asset ratio fund survey’s median as reported in SuperRatings Fund Crediting Rate Survey as at 30 June 2023.

3. Chant West Super Fund Fee Survey March 2023, MySuper Default category. Fees and costs can vary from year to year. Past fees and costs are not a reliable indicator of future fees and costs. Fees and comparisons may differ for other investment options and account balances.

4. Mercer Super Trust’s analysis of Mercer SmartPath after investment fees and tax, compared to the median of all default funds reported in SuperRatings Fund Crediting Rate Survey – Default Options as at 30 June 2023. Note: While Mercer Super did not feature in the official June 2023 survey, Mercer Super is captured in the revised data file. Based on Mercer SmartPath membership data as at 31 March 2023 and for members invested for the full 2022/23 financial year.

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence #235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 (‘Mercer Super’). Any advice is of a general nature only, and does not take into account the personal needs and circumstances of any particular individual. Prior to acting on any information, you need to take into account your own financial circumstances. Please consider the Product Disclosure Statement, Product Guide, Insurance Guide, Financial Services Guide and Target Market Determination (TMD) before making a decision about the product, or seek professional advice from a licensed, or appropriately authorised financial adviser if you are unsure of what action to take.

All performance figures stated above are for investment options available in the Corporate Super Division of the Mercer Super Trust. Past performance is not a reliable indicator of future performance.