When you’re in the early days of your working life, retirement may seem distant, and your super unimportant. However, by planning and acting early, you can make the most of compounding returns to grow your super balance over the long-term, giving you peace of mind that you’ll have financial freedom when you decide to stop working.

Start simple and get the basics sorted

The first and arguably one of the most important steps in your super journey is getting the basics sorted.

Know your Super Guarantee rights

Super Guarantee (SG) contributions will be paid consistently throughout your working life, likely forming the foundation of your super balance – so it’s important you understand the rules relating to them.

While there are a number of rules you should be aware of, most importantly is your employer is typically required to make at least quarterly SG contributions on your behalf to your super account. The value of SG contributions are normally calculated as a percentage of your ordinary time earnings. As at 1 July 2024, the percentage is 11.5%, increasing to 12% by 1 July 2025.

Visit our dedicated Super Guarantee (SG) webpage to learn more about your employer’s responsibilities and what you can do if you think your employer has made a mistake.

Nominate your choice of super fund

Not all super funds are made equal, with each fund performing differently and charging differing amounts of fees. How your super fund performs over the long-term can make a significant difference to your final balance – especially when strong investment performance is combined with low admin fees2.

As it's your super, it's your choice which super fund your employer pays it to.

Visit our dedicated Choice information webpage to learn more, including how to nominate Mercer Super as your choice of super fund.

Review your investment option choice

Once you’ve decided on a super fund, you should consider what type of investment option(s) you’d like to be invested in.

Younger people typically have a long investment time frame of 30 years or more, meaning your investments have time to recover from any short-term losses, so you might target long-term growth over security.

But your personal circumstances are unique, so it may be worth seeking advice. Most Mercer Super members have access to e-Advice, a self-service tool, designed to provide the advice you need to make investment decisions for your personal circumstances.

Sacrifice a little salary today for a big boost to your super tomorrow

Salary sacrificing lets you contribute to your super, while also reducing the amount of income tax you pay.

By asking your employer to contribute even a small additional amount of your take-home pay to your super account each time you're paid money that you otherwise would’ve paid as tax is deposited into your super account.

If done over decades, or even just several years, salary sacrificing can provide a significant boost to your super balance by the time you reach retirement age.

Visit our dedicated salary sacrifice webpage to learn more about the benefits and other considerations.

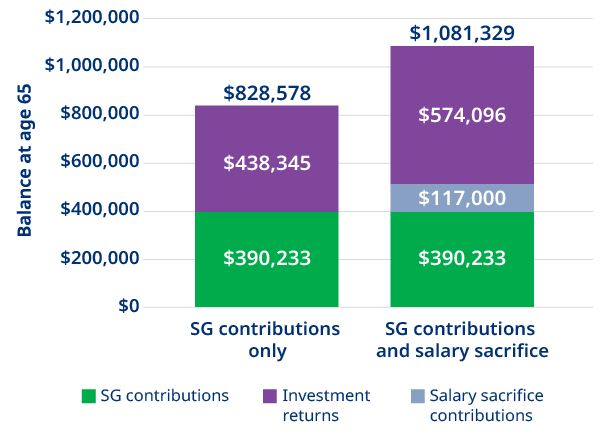

Example: A little can go a long way - salary sacrificing $50 a fortnight1

Let the government lend a hand

The super co-contribution is an Australian Government initiative, helping low and middle-income earners add money to their super.

Under the scheme, the Australian Government will automatically contribute up to $500 to your super account, if you make a personal contribution to your super and meet their eligibility criteria.

Don’t hope for the best, plan for it with financial advice

As a Mercer Super member you can have access to financial advice about your super at no additional cost. Talk to us now to learn more about your options.

Read next:

Grow your super

From your first job to retirement, take steps to boost your super and secure your financial freedom.

Ages 30-58: Building momentum

During this stage, many people are well into their careers, often earning more than when they were younger.

Ages 59 and beyond: Balancing withdrawals and growth

As retirement draws closer, people often look to downsize their home or work less, but not retire completely.

1 Assumptions: Superannuation Guarantee (SG) contributions commenced at age 18 in 2023 and ceased at age 65. Salary sacrifice arrangement is $50 per fortnight, commencing at age 20 and ceasing at age 65. All future figures have been discounted for inflation. Wage growth matches inflation, except for specific age-based changes in salary, which are as follows – age 18 ($45,906), age 21 ($58,635), age 35 ($78,192), age 45 ($80,298) and age 55 ($71,417). SG rate starts at 11%, rising to 12% in 2025 as per legislative schedule. Growth oriented super based returns of 4.46% p.a. after inflation. Difference in returns (which may be positive or negative) and fees will alter the outcome. Contribution caps have been assumed not to be exceeded. The example shown may not apply to your own situation, so we recommend you consider your options carefully and seek financial advice if you’re unsure if making additional contributions is right for you. Past performance should not be relied upon as an indicator of future performance.

2 ChantWest MySuper Default Fee Tables June 2024 – for $50,000 and $100,000 account balances. Fees are for Mercer SmartSuper - SmartPath® (our MySuper product) as at 30 June 2024 for total administration fees and costs. Chant West uses our 1964-1968 investment option for purposes of comparison with other MySuper funds. You may pay less than this if you are in an employer plan with discounted fees. For more details on fees for each of our SmartPath options, or if you’ve chosen your own investment option/s, go to the ‘How Your Super Works' guide online. Fees and costs can vary from year to year. Past fees and costs are not a reliable indicator of future fees and costs. Fees and comparisons may differ for other investment options and account balances.

Disclaimer: Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence # 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice, please consider the Product Disclosure Statement available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd.

The material contained in this document is based on information received in good faith from sources within the market and on our understanding of legislation which we believe to be accurate. Neither Mercer nor any of its related parties accepts any responsibility for any inaccuracy.

This information is based on the interpretation of current tax laws which may change. You should obtain your own tax advice.

Mercer financial advisers are authorised representatives of Mercer Financial Advice (Australia) Pty Ltd ABN 76 153 168 293, Australian Financial Services Licence #411766. The value of an investment in the Mercer Super Trust may rise and fall from time to time.

The investment performance, earnings or return of capital invested are not guaranteed. Past performance is not a reliable indicator of future performance. 'MERCER’ is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.