As you enter this next stage of life, you may be looking to looking to retire, or just work a little less. That doesn't mean your super can't still keep working for you though – this stage of life brings with it several strategies that can help give your super a leg up.

Downsize your home and upsize your super

As people get closer to retirement age they may choose to downsize their home as their life circumstances change.

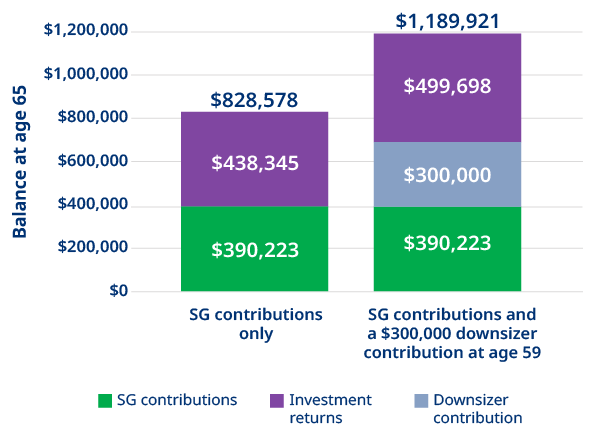

This presents a significant opportunity if you’re aged 55 or over, because you can make a one-off super contribution of up to $300,000, using proceeds from the sale of your primary residence.

If you have a spouse, they may also have the option to contribute up to $300,000 to their super – bringing the total contribution amount up to $600,000 per couple.

Although this contribution will undoubtedly bolster your super balance, it’s also uniquely flexible in that:

- There is no age limit on this contribution

- It doesn’t matter if you’re working full-time, part-time or retired

- it doesn’t count towards either of the contribution caps – meaning there isn’t a risk of the contribution being taxed.

You can learn more about the eligibility criteria, as well as how to make a downsizer contribution on the ATO’s website.

Example: Smaller home, bigger super – $300,000 downsizer contribution1

Break through the annual cap on personal contributions

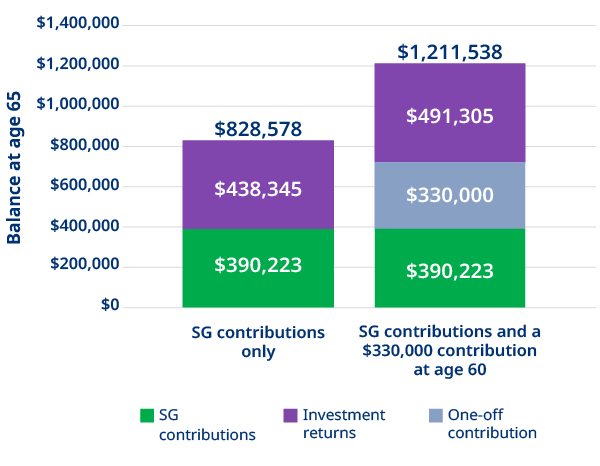

While the annual cap on personal contributions is $120,000, the bring-forward rule allows you to contribute up to three years’ worth of contributions at once – totalling $360,000.

This is particularly useful in situations where individuals have come into a large sum of money such as an inheritance and are looking to significantly boost their super quickly without tax implications.

You can learn more about bring-forward rule, including eligibility criteria on our dedicated contribution caps page.

Example: Planning ahead with the bring-forward rule – $330,000 one-off contribution2

Work less and let your super share the load

If you're nearing retirement age and want to work a bit less, a transition to retirement strategy may be useful. You can access some of your super while still working part-time, helping you maintain your lifestyle while potentially reducing your taxable income.

Learn more about using your super to transition to retirement, including benefits, eligibility criteria, how to do it and other considerations on our retirement hub.

Don’t hope for the best, plan for it with financial advice

As a Mercer Super member you can have access to financial advice about your super at no additional cost. Talk to us now to learn more about your options.

Read next:

Grow your super

From your first job to retirement, take steps to boost your super and secure your financial freedom.

Younger than 30: Laying the foundation

As a younger person you have one of the most powerful super building strategies available to you. You have time.

Ages 30-58: Building momentum

During this stage, many people are well into their careers, often earning more than when they were younger.

1. Assumptions: Superannuation Guarantee (SG) contributions commenced at age 18 in 2023 and ceased at age 65, as well as a one-off downsizer contribution of $300,000 at age 59. All future figures have been discounted for inflation. Wage growth matches inflation, except for specific age-based changes in salary, which are as follows – age 18 ($45,906), age 21 ($58,635), age 35 ($78,192), age 45 ($80,298) and age 55 ($71,417). SG rate starts at 11%, rising to 12% in 2025 as per legislative schedule. Growth oriented super based returns of 4.46% p.a. after inflation. Difference in returns (which may be positive or negative) and fees will alter the outcome. Contribution caps have been assumed not to be exceeded. The example shown may not apply to your own situation, so we recommend you consider your options carefully and seek financial advice if you’re unsure if making additional contributions is right for you. Past performance should not be relied upon as an indicator of future performance.

2. Assumptions: Superannuation Guarantee (SG) contributions commenced at age 18 in 2023 and ceased at age 65, as well as a one-off after-tax contribution of $330,000 at age 60. All future figures have been discounted for inflation. Wage growth matches inflation, except for specific age-based changes in salary, which are as follows – age 18 ($45,906), age 21 ($58,635), age 35 ($78,192), age 45 ($80,298) and age 55 ($71,417). SG rate starts at 11%, rising to 12% in 2025 as per legislative schedule. Growth oriented super based returns of 4.46% p.a. after inflation. Difference in returns (which may be positive or negative) and fees will alter the outcome. Contribution caps have been assumed not to be exceeded. The example shown may not apply to your own situation, so we recommend you consider your options carefully and seek financial advice if you’re unsure if making additional contributions is right for you. Past performance should not be relied upon as an indicator of future performance.

Disclaimer: Please note that any information in this material regarding legal, accounting or tax outcomes does not constitute legal advice or an accounting or tax opinion and prior to relying and acting on this information it is important that you seek independent advice from a qualified lawyer or accountant regarding this information.

Issued by Mercer Superannuation (Australia) Limited ABN 79 004 717 533, Australian Financial Services Licence # 235906, the trustee of the Mercer Super Trust ABN 19 905 422 981 ('Mercer Super'). Any advice provided is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any advice, please consider the Product Disclosure Statement available at mercersuper.com.au. The product Target Market Determination can be found at mercersuper.com.au/tmd.

The material contained in this document is based on information received in good faith from sources within the market and on our understanding of legislation which we believe to be accurate. Neither Mercer nor any of its related parties accepts any responsibility for any inaccuracy.

This information is based on the interpretation of current tax laws which may change. You should obtain your own tax advice.

Mercer financial advisers are authorised representatives of Mercer Financial Advice (Australia) Pty Ltd ABN 76 153 168 293, Australian Financial Services Licence #411766. The value of an investment in the Mercer Super Trust may rise and fall from time to time.

The investment performance, earnings or return of capital invested are not guaranteed. Past performance is not a reliable indicator of future performance. 'MERCER’ is an Australian registered trademark of Mercer (Australia) Pty Ltd ABN 32 005 315 917.